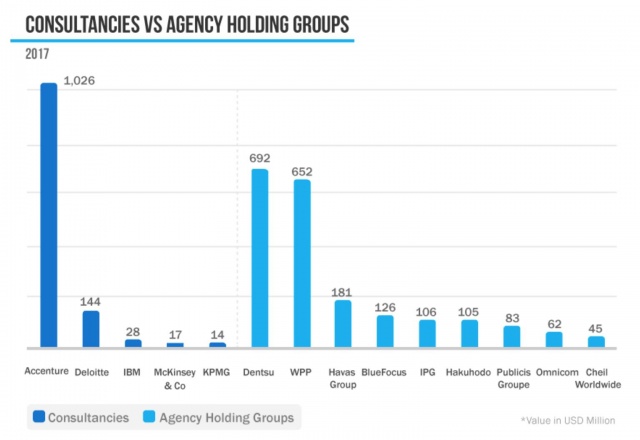

NEW YORK – JANUARY 16th, 2018 – While M&A in the marketing services industry was generally flat year on year, 2017 saw significant shifts beyond the agency groups in terms of acquisition volume, according to a recent report by independent consulting firm, R3. Based on their analysis, Consulting Firms such as Accenture, Deloitte, IBM, KPMG and McKinsey invested $1.2b in agency acquisitions in 2017, a 134% increase on 2016. By contrast, Agency Holding groups including WPP, Dentsu, Omnicom, Interpublic and Publicis declined by 46% to $1.8b.

M&A DEAL VOLUME – CONSULTANCIES VS AGENCY GROUPS – 2017

“It’s clear that the consulting firms have seen the opportunities and are more willing than ever to open their wallets for them” said Greg Paull, Principal of R3.“Accenture alone invested more in 2017 on acquiring agency assets than WPP, Omnicom, Interpublic and Dentsu combined – most of who had depressed stock value through the year,” he added.

STRONG GROWTH IN EUROPE, DECLINE IN ASIA

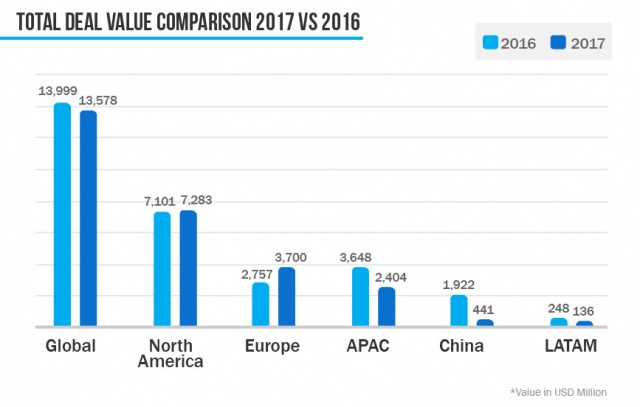

R3 assessed 401 deals across the year in the marketing communications space, just a slight increase on 2016’s 398 deals. Overall, $13.5b of M&A funds were invested in these deals, a 3% decrease on the previous year.

By region, Europe saw the largest increase (34%) with $3.7b in deals despite the decrease in the overall number. “All of the top ten Europe deals involved at least $100m in transaction value each as WPP, Dentsu and some non-traditional acquirers took advantage of slower business conditions to make some significant moves,” added Mr. Paull.

The US continued to lead the other regions, on both the volume ($6.6b) and number of deals (202) through the year, including Williams Lea Tag, Turn and Rocketfuel. “With the growth of the duopoly, the issue for Adtech firms is really fight or flight – so it won’t surprising to see a flurry of more M&A in this space in 2018” said Mr. Paull.

Both Asia (-34%) and Latin America (-45%) declined in terms of deal size through 2017, led mostly by China (-77%) where there were just 16 deals completed. “China has become a “wait and see” situation for a lot of the global holding companies – given that most of the sales transacted this year involves local firms.” said Mr. Paull. “There’s no shortage of interest, though and we would expect this to pick up through 2018,” he added.

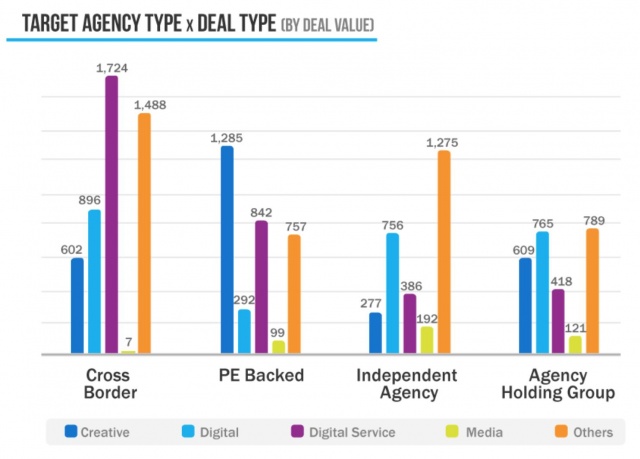

DIGITAL / DIGITAL SERVICE ARE IN DEMAND

It was another strong year for Digital and Digital Service acquisitions, with these two categories representing $6b combined in value over 2017. The creative number was bolstered by Bain Capital’s December acquisition of ADK Japan.

“As marketers are grappling internally with true digital transformation, they will continue to look towards agencies for support in this area,” said Mr. Paull.

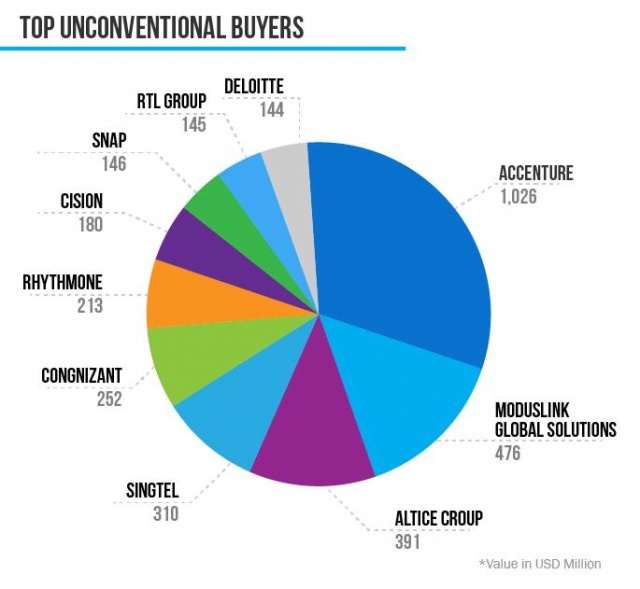

THE YEAR OF THE UNCONVENTIAL BUYER

Spread throughout the year was an increasing number of unconventional buyers, outside the traditional acquirers. From Snap Inc. to the New York Times to boutique Private Equity groups, this was truly a year where investment ideas could come from anywhere. All regions were ultimately led by one of these firms.