It’s been an active six months in acquisitions in marketing communications with a 286 per cent increase over 2015, mostly driven by big China deals and big digital investments.

A series of new players have also emerged with IBM, Accenture, Deloitte and tech players such as Telenor investing in agency assets.

This year R3 has tracked 204 deals with a total value of over $6.8bn and an average value of $33m per deal. Thus far the US and China are leading global M&A activities by transaction volume, followed by India and the UK. However, when measured by number of transactions, the US (77) leads the UK (38) and China (22) by a significant number.

It’s not surprising that 53 percent of the acquisitions in the first half of the year have targeted digital assets. Under the umbrella of digital, “ad-tech,” “analytics” and “full service” digital agencies were most popular. Digital deals also accounted for over 62 per cent of total deal value, with creative and media accounting for ten per cent and seven per cent respectively.

Large deals were driven by cross-border and private equity-backed backed buyers although agency holding groups and agencies announced more transactions. In terms of investment, agencies and agency holding groups are more interested in investing in creative, PR and design companies, while cross-border and PE investment is concentrated in digital and media.

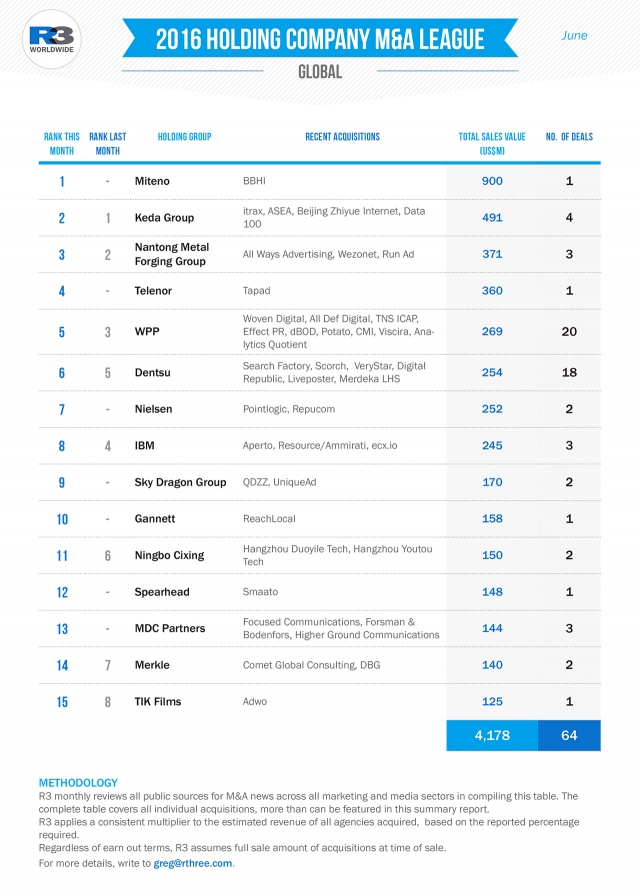

As well as WPP, very aggressive as per usual with 20 deals, Dentsu was also highly active and spent over $254 million on 18 deals. Many of those deals were small to mid-sized investments in developing markets such as Mexico, Malaysia and Egypt. Earlier this year Dentsu announced it was considering as many as 60 M&As in the second half of the year – meaning that we may see an even busier Q3 and Q4.

R3 is a leading global, regional and local consultancy group, focused on improving the effectiveness and efficiency of marketers and their agencies. We enable our clients to get the competitive edge and a better return on investment from agencies, media and marketing spend. With over 100 people in the US, Asia, EMEA and LATAM, R3 works with some of the world’s top twenty marketers including Coca-Cola, Unilever, AB InBev, MasterCard, Mercedes Benz, Johnson & Johnson, Samsung and Kimberly Clark.

R3’s monthly Holding Company M&A Tracking can be found here. Please write to [email protected] with any inquiries.

To see the full Q1 and Q2 M&A report from R3, please click here.