Of the 398 marketing startup acquisitions in 2016 only 22% were made by the six major advertising groups, who had to fight it out with consulting companies, IT firms, and publishers.

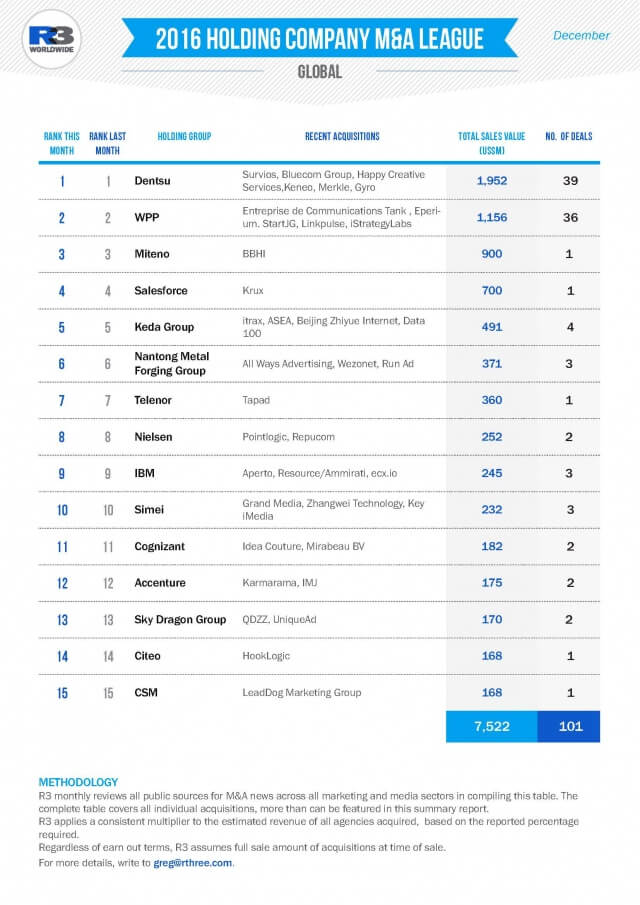

Global consulting firm R3 releases a yearly ranking of mergers and acquisitions in marketing. The total deal value rose to $14 billion, 150% more than in 2015. Consulting firms made considerable moves into advertising agencies’ turf last year with acquisitions of small creative agencies.

IBM, for example, bought a number of boutique digital and creative shops totaling $240 million. Deloitte acquired the award-winning creative agency Heat. Accenture spent $40 million more on marketing startups in 2016 than the previous year with its acquisition of London-based agency Karmarama becoming a key part of its push into marketing.

Marc Benioff’s Salesforce ranked fourth in 2016 marketing M&A with its $700 million acquisition of Krux.

Tech companies also continued their push into marketing. Fourth on R3’s list of marketing acquirers was Salesforce with its $700 million acquisition of the marketing platform Krux. Google acquired the YouTube influencer marketing agency Famebit.

In a shift from the previous year, publishers emerged as new players in the marketing space as they looked to extend their revenue streams. The New York Times, the FT, Time Inc. and Vice all acquired branded content or influencer marketing companies in 2016.

Leading the ranking is Dentsu with over $1.9 billion in dealflow, pushed up largely due to its acquisition of Merkle, estimated at $1.5 billion. WPP wasn’t far behind, with 36 acquisitions and $1.1 in deal value.

Absent from the ranking were tech companies like Adobe which acquired video advertising platform TubeMogul or Oracle and SAP, which have their own marketing and e-commerce solutions. In 2017 R3 predicts tech companies such as Amazon, Facebook, Google and Salesforce to be more active.

Greg Paull, Principal & Co-Founder

“They have the cash, and they are continuing to take leadership roles on content creation,” said Greg Paull, Principal and co-founder at R3.

Source: Business Insider