Dentsu’s seven October deals vaults it ahead of WPP and Omnicom globally, but holding companies are giving way to a wider variety of investors in marketing deals

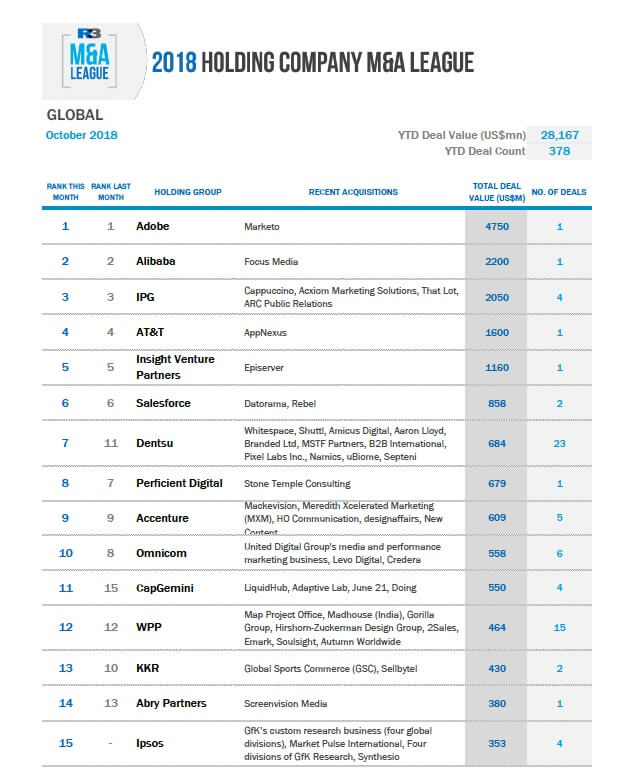

Dentsu has been on the prowl of late, recording no less that seven deals last month, pushing it up from 11th spot to seventh globally on the R3 M&A League.

The deals included Dentsu’s purchase of Hong Kong live events media company Branded Ltd and a stake in Japanese digital marketing conglomerate Septeni. It also picked up three agencies in Europe (creative agency Partners in Portugal, digital agency Namics in Germany/Switzerland, research firm B2B International in the UK) and two technology firms in the US (news platform Pixel Labs; health testing firm uBiome).

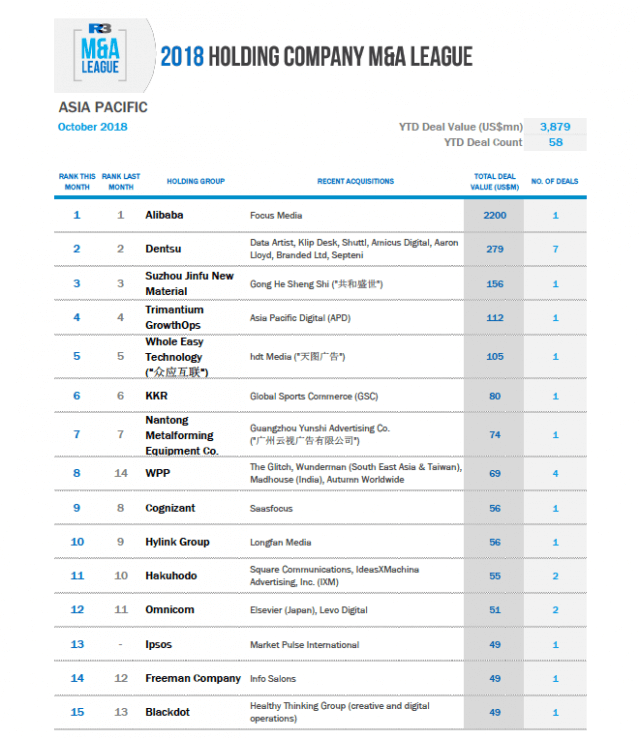

The spate of deals was enough to push Dentsu into seventh place globally, ahead of Omnicom (eighth) and WPP (12th), but well behind IPG in third, thanks to its Axciom acquisition. But the rest of the top 15 marketing acquirers this year are non-holding groups, reflecting how diverse the marketing sector has become. Martech companies (Adobe, Salesforce), consultants (Accenture, CapGemini), private-equity firms (Insight Venture Partners, KKR) and ecommerce companies (Alibaba) are all active in the sector.

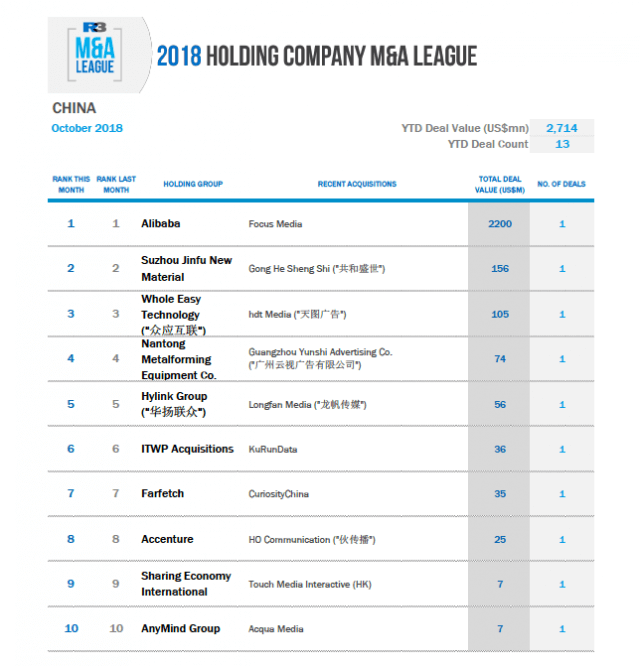

This is most evident in China, where not one holding group is among the top 10 acquirers, which include companies like Suzhou Jinfu New Material, Whole Easy Technology and Nantong Metalforming Equipment Co.

In Asia-Pacific, WPP re-entered the top 10, but otherwise the M&A League remained largely unchanged.