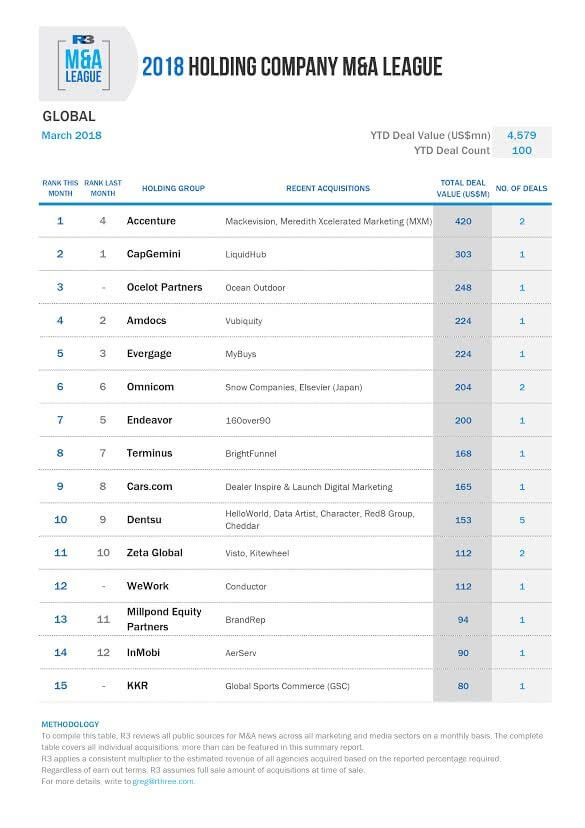

Agency focussed M&A more than doubled in the first quarter of 2018 compared to 2017 (100 deals worth $4.6bn against 94 worth $2bn in 2017) according to marketing consultancy R3 – but just 14 per cent of deals were done by the usual suspects, agency holding companies.

R3 principal Greg Paull says: “The consultants and other non traditional buyers are taking the lion’s share of the assets. The holding groups have their own internal challenges – along with those from their shareholders – but more than enough other investors are stepping in.”

Consultants and private equity lead the way

2017’s leading players in terms of deals, Dentsu and WPP, were both relatively quiet in the first quarter of 2018, with just eight of the hundred deals between them. The consultants led by Capgemini and Accenture led the way with major investments including Meredith Xcelerated Marketing and LiquidHub in the US. Paull says: “Consultants have the client base, the C-Suite relationships and the cash to expand aggressively in the marketing sector. We expect them to be equally active through the rest of the year.”

PE firms have also been active with Ocelot Partners (which bought the UK’s Ocean Outdoor, below), Milpond and KKR among the top buyers. All three went beyond traditional agencies to explore value in the outdoor, sports marketing and digital sectors.

The R3 report also covers some more unusual acquisitions this quarter. Office co-working company WeWork invested in Search Agency Conductor with an eye to setting up a marketing cloud. Dentsu Ventures invested in Cheddar, an on-demand broadcaster in the US targeting millennials and competing with CNBC and Bloomberg. Nordstrom bought two retail digital agencies. And L’Oreal invested in AR/AI firm Modiface.

R3 is an independent global marketing consultancy working with some of the world’s top twenty marketers including Coca-Cola, Unilever, AB InBev, MasterCard, Mercedes Benz, Johnson & Johnson, Samsung and Colgate Palmolive.