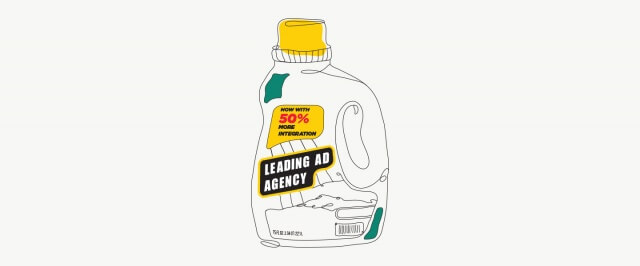

The ongoing demand for integration in the agency industry is experiencing collateral damage: the dissolution of individual agency brands.

At Publicis, the iconic Razorfish brand is slowly being phased out, part of a larger plan that will fold the agency into Publicis.Sapient. An agency spokesman said that the Razorfish brand does still exist in some markets, based on client needs. In Asia, for example, sources said that it did not exist on its own any more, while in New York, it now exists as Sapient.Razorfish.

While slightly different, the merger of digital agency VML and legacy creative company Y&R to create VMLY&R is also indicative of the trend. The idea is to combine the two agencies’ capabilities. In a statement, newly installed WPP CEO Mark Read called it a step to building a “new, simpler WPP that provides clients with a fully integrated offering.”

This merger came just a year after VML absorbed Rockfish, an e-commerce-focused digital shop.

VMLY&R’s new CEO, Jon Cook, said that for clients, it’s been a bit of a toss-up. “There is a healthy demand where clients appreciate the simplicity of constructs,” he said. “But there is still an appropriate and healthy demand also for an agency brand. If there hadn’t been, we could have named the new company something like ‘LaserFrog.’”

Still, client demands have affected name-brands, especially those inside holding companies. And that’s because a holding company’s own rationale has shifted. Created ostensibly for economies of scale, holding companies mostly served the purpose of being able to have different clients within the same company and avoid any perception of conflict.

But as the market shifted, the holding company’s inherently siloed structure, with multiple P&Ls, is being called into question. There’s also new competition from consulting firms, which are making their mark by offering increasingly integrated services that do everything from design to digital to business transformation.

But in this market, individual “brands” could matter less.

A top holding company agency exec, who declined to speak on the record so as not to worry her colleagues, said that in her experience, clients are just asking for more. She’s seen more global clients simply ask for customized groups of people — top talent from across the holding company — and to get a diversity of the agency brands. “They don’t care if a certain brand is involved. But they do like being told that this brief is being solved by groups from three different agencies, for example.”

Greg Paull, co-founder and principal of marketer consultancy R3, has found more demand for the “team” concept that sees multiple groups within holding companies come together to offer supposed bespoke offerings for clients. “And in some ways, advertisers care more about the people that work on the account, rather than the agency name,” said Paull. “The dirty secret in agencies is that senior management spends half their time pursuing new business and not working on client work. In some ways, this is an attempt to try rectify that.”

Ray Velez, the global chief technology officer at Razorfish, said that Razorfish’s continued evolution is par for the course. Founded in 1994 as a web development company, it went through multiple iterations before being taken private in 2003 and renamed as SBI.Razorfish, then renamed again as Avenue A/Razorfish following an acquisition by AQuantive in 2004. After being owned by Microsoft for two years, Publicis then acquired the company in 2009. In 2016, it merged with Publicis’ SapientNitro to form SapientRazorfish.

“There is a tension here,” said Velez, who has been with the company for 20 years. “You want to encourage and grow collaboration and expertise and best practices.” Velez said that traditionally, advertising has always operated within silos across agency brands. But as client demands change, there is more need for integration, especially inside holding company structures.

“We have to keep this as brand boundaries start to go away,” said Velez.

Paull said that more clients are demanding that holding groups are more synergistic across agencies — something that has to changed the role of individual agency brands. “Publicis in particular went to a lot of effort to buy a lot of digital assets,” said Paull. “Through a number of mergers and acquisitions and realignments, DigitasLBI, Razorfish and Sapient have become a bit of a melange. The challenge is for these individual brands to stand for something. It’s been a challenge for them to create this identity and positioning.

For digital agencies particularly, said Paull, this may be harder, partially because of an advertiser mindset that still tends to only hire digital shops on a project basis. That means “brands” can matter even less.

One exception to this, say industry observers, are independent companies like Wieden + Kennedy and Droga5, which continue to see immense growth. “We’ve seen that indie brands are more competitive and hungrier than holding company brands,” said Paull. “These agencies have a clear position and competitive approach that keeps resonating.”