The tide is turning from outside investors coming in, to inside investors looking out

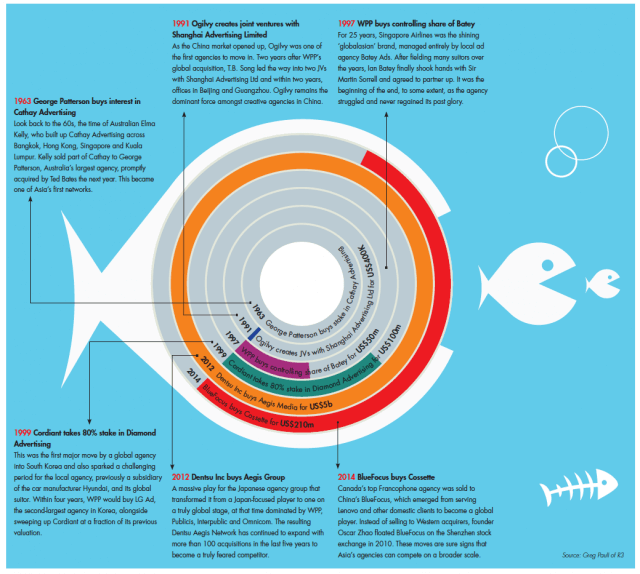

Cast your mind back to the 1990s. A mergers-and-acquisitions (M&A) trend is sweeping adland in Asia, driven primarily by the western agency groups seeking to establish a foothold in the new markets attracting their clients—clients that are increasingly merging with one another themselves.

That same urge to find bigger clout and become more competitive by making operational savings hasn’t decreased over the decades, despite the disbelievers who argued that M&As were more logical for banking or internet firms than the advertising world.

Some say any attempt to bring together the best collection of creative brains should not be based on equity structures, which will only give rise to corporate culture clashes and political in-fighting among stakeholders. Indeed, there remain many bungled creative hot-shop acquisitions we couldn’t report due to the shackles of non-disclosure agreements.

The real impact of consolidation was felt in the fields of media planning and buying, especially in populous Asian markets. The bigger the umbrella conglomerate, the greater the bargaining power with media owners and the higher the success rates in retaining existing clients and luring new ones. Over the past 50 years, agencies have developed deep experience in various specialisations to enable them to serve more sophisticated clients, meaning there are now plenty of fish in the sea for future buyers.

The tide is turning, however. M&A patterns are shifting from “outside investors coming in, to inside investors looking out”, according to Greg Paull, principal of pitch consultancy R3. Look, for example, at Alibaba and Tencent’s reported interest in a 20% stake in WPP China, as well as the expansion roadmaps of China’s BlueFocus, South Korea’s Cheil and Japan’s Dentsu.

In 2013, BlueFocus’ 82.8% stake in We Are Social was the first cross-border acquisition in China’s communications sector, but the likes of Hylink, Spearhead, Leo Group and Charm, all publicly traded and propped up by the mainland capital markets, have potential to be the next high-profile deal-seekers. Their wealth, and aggression, will continue to skew M&A development in Asia and beyond.

China will likely carve a different path, predicts Andrew Kefford, regional director for Asia Pacific and MENA at Results International. The Chinese tech titans, already central to O2O marketing technology, operate within their own closed systems capturing more and more invaluable consumer browsing and buying information that will enable hyper-targeting.

As they buy their way through to market dominance, they’ll enhance their ability to combine their own media opportunities and data capabilities with creative aptitude.

That potential first-mover advantage may be what (arguably) the world’s most pivotal acquirer, WPP, couldn’t hope to achieve at this time