R3 predicts more media reviews and greater focus on transparency

According to the latest new business league report from international consultancy R3, the ad industry will increasingly focus on three topics in 2018: transparency, media reviews and acquisitions. In the latter case, rumors about a global firm moving to acquire a major holding company might actually come true.

One thing is clear: Two years after “Mediapalooza,” the trade press needs a new name for the never-ending flood of big-name reviews media agencies everywhere are calling the new normal.

Noting McDonald’s decision to call on the major holding groups to pitch for its global media, Amazon’s consolidation of its $1 billion-plus account with IPG, and the news that longtime WPP client Ford is “exploring options to improve the fitness” of its advertising business, R3 founder and principal Greg Paull predicts even more pricey pitches next year.

Paull told Adweek the industry is still in the middle of a wave sparked by the ANA’s media transparency report, which was released 18 months ago.

“I think what’s driving that is a combination of frustrated marketers not getting their expected ROI on digital and the cycle,” he said of the endless media pitches. “[Marketers] have been waiting a year or so after the ANA feedback and haven’t necessarily made the progress they’d expected.”

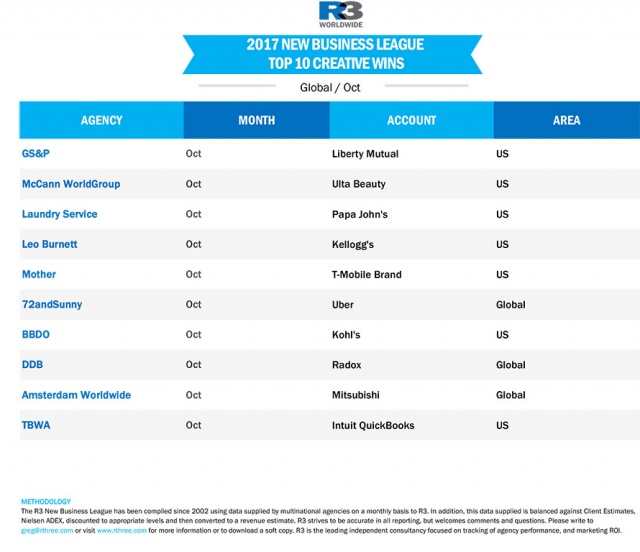

Paull also believes transparency will continue moving the larger conversation. He said agencies that have been able to sell their own transparency as a differentiator, like GroupM’s Mediacom, IPG Mediabrands and Dentsu’s Vizeum, have come out on top in recent reviews—as indicated in the chart below.

But this movement doesn’t end with RFIs.

According to a new survey released by the ANA this week, a growing number of clients are moving their own programmatic ad buying responsibilities in-house. This could pose another challenge to media agencies hit by recent efficiency-based spending cuts from big names like P&G and Unilever that primarily affected digital ad buys.

“There’s no shortage of big marketers taking a look at their global investments,” Paull said. “Lots of our clients are trying to take greater control of their data, and in many cases, it’s sensitive info you might not want to share with a third party.”

On the creative side of the industry, agencies continue to compete for smaller pieces of the pie. Home-improvement giant Lowe’s was the most recent client to announce it would be moving away from the AOR model and assigning project-based work to “a roster of creative agencies.”

This trend makes wins like Liberty Mutual (which went to GS&P) and Papa John’s (Laundry Service) all the more significant.

Paul specifically said Laundry Service’s recent wins in the Papa John’s and Lincoln reviews mark “a really strong sign that a digital-first mindset is critical” in the agency world, as the shop is not generally known for its broadcast work.

So what does Paull see coming in 2018? More reviews and agency consolidation moves, and maybe a big acquisition.

“What you’ll see is digital assets merged in with the ad agencies—DigitasLBi merging with Leo Burnett, for example, or Organic moving inside of DDB,” he said, echoing the idea that digital work will increasingly take precedence for big brands.

In keeping with widespread industry rumors, Paull also thinks a global firm like Accenture or Deloitte will most likely begin “fishing around” and exploring the potential acquisition of a holding group in 2018, especially in light of WPP’s disappointing third-quarter earnings report.

“This was the first year that anyone truly recognized the fact that the model’s under threat,” he said. “Next year will be an interesting tale of how [the holding groups] try to move beyond that threat.”

Source: adweek