Advertising agencies and tech companies are increasingly getting into the shark tank game.

As competition heats up for gaining and retaining consumer attention on mobile devices, a growing number of agencies are betting on—and buying into—startups focused on emerging technology. With more major tech companies, consultancies and PR firms getting into the mix, following the money could help forecast trends for this coming year.

Earlier this month, R/GA and its parent, Interpublic Group, announced a partnership with Snap Inc. to create an incubator for companies focused on building mobile and social platforms related to artificial intelligence, content creation and analytics. The program’s news arrived right on the heels of Facebook’s announcement in January that it would open a startup hub called Station F in Paris for data-driven companies.

“Brands and agencies, when they create content and campaigns, they’re really looking to reach a larger audience,” said Stephen Plumlee, R/GA’s global COO. “And when these startups are small and independent, the technology may be amazing, but you’re probably not going to be able to have the insane type of reach that Facebook or Snapchat will bring.”

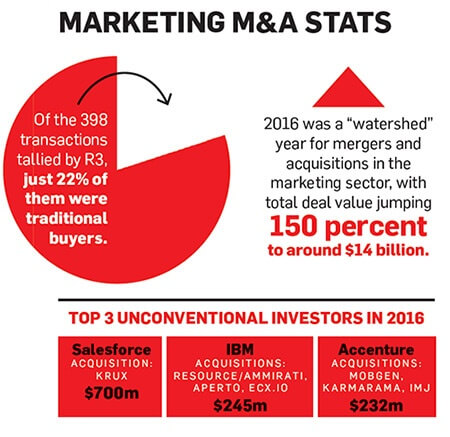

R3, a global consulting firm, said 2016 was a “watershed” year for mergers and acquisitions in the marketing sector, with total deal value jumping 150 percent to around $14 billion. But the space isn’t just growing; it’s getting more dynamic, said R3 principal Greg Paull. Of the 398 transactions tallied by R3, just 22 percent of them were traditional buyers such as agency holding companies.

“The dynamic of building it yourself, the curve for that is going to take too long,” Paull said. “It’s far faster to bring in that capability from the outside.”

According to Paull, the marketing ecosystem is becoming more complicated and complex for CMO types. He said pressure is mounting for them to justify digital investments, which means making sense of data is even more appealing. He said there will likely be more consolidation this year, as tech companies close in on brands’ marketing suites. That could prompt more acquisitions by companies like Google, Facebook and Amazon. (And with plenty of cash on hand, the giants are best positioned to do so, he said.)

Others are choosing to build from the inside out. In 2015, Edelman founded The Yard, an internal incubator for mobile and emerging tech that in a year has grown to more than 30 creative technologists and designers.

ArcTouch and Yahoo collaborated on apps for photo sharing and messaging.

“I can’t even think how we would not do this,” said Andrew Foote, managing director of Edelman Digital New York.

Rohit Malhotra, a managing director at the investment banking firm MergerTech, said he expects to see more M&A activity in the marketing space this year, especially related to customer service management and analytics. Malhotra, who’s currently working on three mobile deals, said companies are betting earlier in order to avoid missing out later.

“The companies that are successful that agencies want to acquire are really thinking of a solution from a product standpoint,” he said.

Last year, Malhotra helped facilitate financing for WPP-owned Grey’s acquisition of ArcTouch, a mobile startup that has developed more than 400 apps for brands such as Audi and Yahoo. With about a third of its business now focused on the Internet of Things, ArcTouch founder Eric Shapiro said it benefitted both the company and Grey: Grey wanted the startup’s capabilities in IoT, VR and AR; ArcTouch wanted Grey’s scale. The timing also seemed right, as most of the other mobile companies had already been snatched up. “We didn’t want to be the last dance partner, so to speak,” Shapiro said.

ArcTouch and Yahoo collaborated on apps for photo sharing and messaging.

ArcTouch is one of several mobile companies acquired by WPP in the past few years. In 2013, Ogilvy bought Bottle Rocket, and in 2014, Possible acquired Double Encore.

Added Shapiro, “This past week, I’ve had conversations with groups at WPP that you’d never expect needed technology.”

ArcTouch created a virtual driving experience for the automaker specifically geared for mobile devices.

Source: Adweek