Chinese Firms and Nontraditional Players Such as IBM and Deloitte Move In

Mergers and acquisitions targeting digital agencies, ad tech companies and analytics firms surged worldwide in the first half, independent global marketing consultancy R3 said in a report on Wednesday.

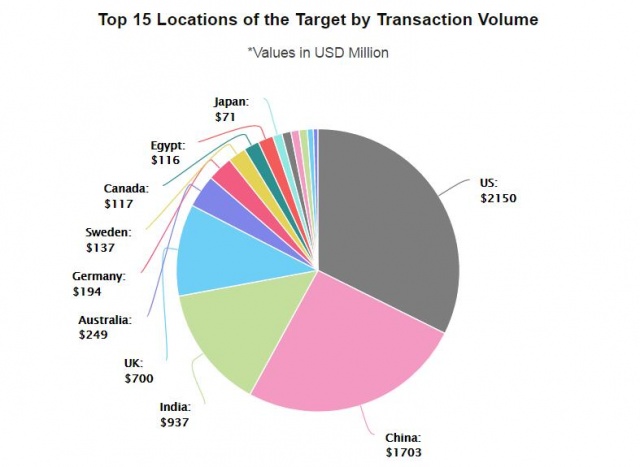

The marketing industry overall saw 204 M&A deals in the first six months of the year, totaling an estimated $6.8 billion, up from 85 deals valued at $2.1 billion in the equivalent period last year, according to R3.

Some of the increase was driven by large investments by Chinese companies. Also driving growth was the entrance of new players like Deloitte, IBM and Accenture, as well as tech players like Telenor, which are aggressively investing in agency assets.

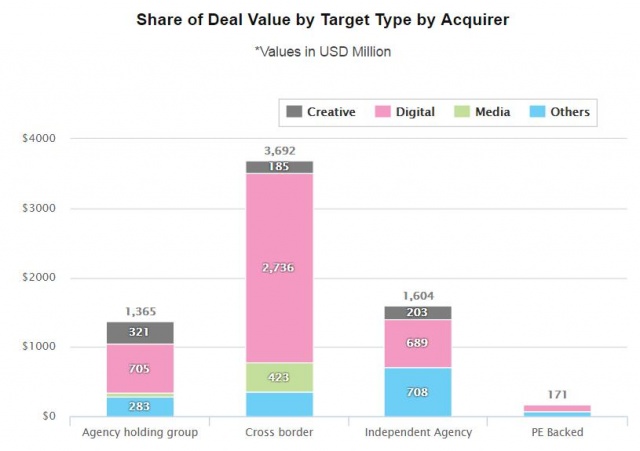

Of the deals so far in 2016, 62% involved digital marketing capabilities, compared with 42% a year earlier. The cumulative value of the deals shot up 288%, R3 said.

At the same time, the amount spent on creative and media agencies was down significantly.

Of the money spent in marketing-business mergers and acquisitions, 10% went toward creative agencies, down from 22%, according to R3. Media comprised 7% of the M&A spending, down from 16%.

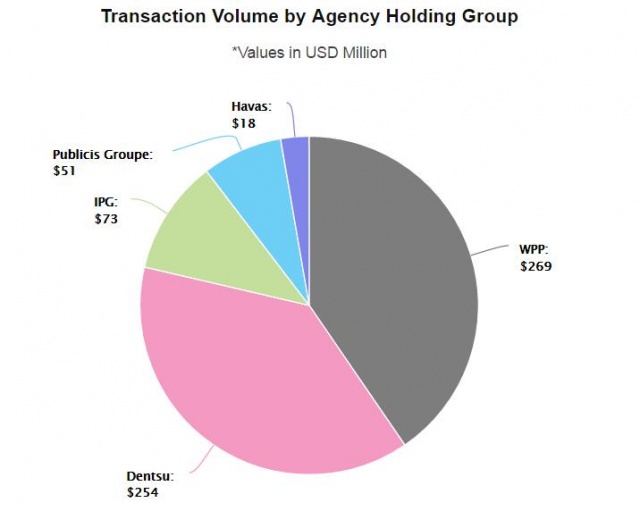

Large deals were driven by cross-border and private equity backed buyers, although agency holding groups and agencies announced more transactions, R3 said. According to the report, agencies and agency holding groups are more interested in investing in creative, PR and design companies while cross-border and private equity buyers are more focused in digital and media. See below the charts for a Q&A with R3.

Ad Age asked R3 co-founder and principal Greg Paull, who spoke to us from Shanghai, for his take on his company’s latest report. The interview has been lightly edited for clarity.

Advertising Age: What were your biggest takeaways from the report?

Greg Paull: Obviously, the diversity of acquirers has come up a lot this year. You see a lot of new companies that weren’t necessarily there before. Everyone from IBM to Accenture. So I think that has been interesting. And a lot of the private equity companies are coming up as well.

So, that is the first thing: It’s no longer the core domain of the ad agencies to be acquiring these entities. And then I think the huge grab for digital. You saw it literally Monday with the Merkle deal. I think everyone is looking to try and bolster their digital capabilities through organic growth, but specifically through acquisitions as well. It’s been a big increase.

Ad Age: And you’re starting to see that as well with the big four consultancies.They’re starting to expand their digital offerings, too, as evident with what Deloitte and PwC are doing right now.

Mr. Paull: Absolutely.

Ad Age: So, a few of the ad tech players have said an ad-tech Armageddon is looming, meaning that there are so many ad tech players that only the best will survive. Do you agree with that?

Mr. Paull: Well, I think so.

I think the challenge with the whole ad tech space is, quite frankly, you really only have two players that are accounting for 70% or 80%, which is Facebook and Google. Those guys have such a dominant stranglehold that they’re doing a lot of the acquisitions of the ad tech groups. They’re also for the first time going direct to marketers and they’ve really become full-service.

So, I think there’s a whole lot of turbulence in the market right now. The challenge also comes back to the agency holding companies, because not only do they have to compete with each other, but they also have to compete with their frenemies, or Google and Facebook.

Ad Age: A good chunk of the acquisitions in your report took place in China. What’s going on?

Mr. Paull: What I think has happened is there are a lot of Chinese conglomerates and they’re not necessarily in the marketing sector, but they’re just large conglomerate companies that believe in diversity. They’re looking at people like General Electric and how they’ve diversified their model in the U.S. and, quite frankly, they’ve gone out to buy digital agencies.

So, you know, they are very asynchronous buyers. They’re coming in with big checkbooks and they’re not looking at the usual multiples that WPP or IPG would look at. It’s become a great opportunity for a lot of local agencies to cash out. There have been a lot of big deals in that space, actually, and the ones that have been acquired are some companies I’ve never heard of. And I’ve been in China for a while. That’s the nature of the market right now.

Ad Age: Were there any acquisitions that you weren’t expecting? Or were there any that you thought were a brilliant move?

Mr. Paull: I would go back to the Dentsu-Merkle deal, but that’s too recent.

I think what IBM did in getting digital creative shop Resource/Ammirati was a great acquisition. And they picked off one big agency per region. So, they bought something in Germany, something big in the U.S. and something big in Asia. They’re trying to build their capabilities in a very strategic way. They’ve done three acquisitions and they’ve acquired almost as much as WPP or Dentsu who have done 20. They found some large entities and I think what they’re doing is pretty interesting.

Ad Age: IBM has definitely built out a strong digital consulting unit. Can you elaborate on that?

Mr. Paull: They believe digital is all-encompassing and with the acquisition of people Resource/Ammirati — that’s one of the top digital agencies in the U.S. that has 600 or 700 people with a decent network — that’s going to fit in nicely with what IBM is trying to do. They already have the relationships with the CFOs and the CEOs and this is their chance to really build it up with the CMOs. That’s kind of their vision of how they see their growth.

Ad Age: What trends do you expect to see play out in the second half of 2016?

Mr. Paull: I think you’re going to see a lot more data deals. We’ll see a lot more Merkle’s of this world, that’s just the first. We’ve been talking to them for quite some time about potential deals as well, and there are four or five others similar to Merkle that I think will be on the radar of some of the holding groups.

But they’re going to be very data-centric companies. They’re not going to be the sexy 72andSunny‘s or whatever of this world. It’s going to be a very different group.

Ad Age: When Deloitte snagged Heat, that was seen as sort of a different play there. They’ve been saying that when they’re trying to win clients over, it’s “like cheating” because they have all this data from Deloitte so when they’re making their pitch they already know what they want to hear. At least that’s what they were trying to sell to me.

Mr. Paull: That’s a great point. Without data, I don’t know what a creative agency does anymore. That could be a great partnership.

Source: Adage