The short answer is, “partly”. It’s all too easy to look for a single, rather exciting, cause behind the 21 (according to R3) global and North American media reviews but the truth is more complex, agree industry sources.

Digital is seen as the driving force behind the frenetic rate of pitching.

With 10 per cent of global billings up for pitch affecting nine per cent of Asia-Pacific billings (estimates Ebiquity), there has never been a pitch onslaught quite like the one that’s happening now. The nearest the industry has come to a situation such as this one was in 2008, following the global economic downturn.

Many articles published by industry trade magazines are quick to point to ex-MediaCom CEO John Mandel’s ‘tell-all’ at the ANA conference in March. This, coupled with the furore over recently reported irregularities in Mediacom Australia’s account reporting, assert several parties, has led to the current pitch frenzy which is aimed at a major overhaul of client-agency contract agreements.

GroupM’s Rob Norman has responded with a statement asserting that “rebates and “other types of hidden revenue are not part of GroupM’s trading relationships with vendors” in the US. So far, GroupM Asia-Pacific has not responded to a request for comment.

Views from agencies and pitch consultancies have been sharply polarised. After all, consultants would benefit from clients feeling anxious and calling for pitches, pointed out Nick Waters, CEO of Dentsu Aegis Network Asia-Pacific.

“[The transparency argument] is a big red herring,” he said. “Look at companies putting their business up for tender—these are among the world’s leading marketing organisations. To get to this position involves getting a lot of internal stakeholders aligned. This doesn’t happen quickly and is accomplished over the course of many months and managed on a multi-year basis.”

Jon Mandel, Waters added, left the agency-side 10 years ago and is now himself a consultant. “He is not unbiased.”

A spokesperson for OMG has likewise pointed out that working with MNC clients assures a high degree of transparency with all due rigour and processes. “These sophisticated clients require that we work with third-party auditors.”

Another senior agency source said that transparency wasn’t a part of the conversation for any of the pitches they were involved in until the media made it an issue. “We have since had conversations with our clients about it but rebate transparency is really not a major concern for them.”

Agencies of course are not without bias either. It is in their interest to reassure clients as it would be in their best interest, said consultants.

“While the right to audit, the ownership of data and the right to rebate is all enshrined in any strong client-agency commercial contract, there’s always a need to review and strengthen, to tie up any loop holes an agency may find,” said Martin Sambrook, international practice leader of media for pitch-consultants Ebiquity. “Clients have woken up to the fact that programmatic isn’t just about digital spend, it’s going to be all of the spend and if they don’t get a grip on the transparency and data-rights argument now, they will wind up conceding a lot of ground in the future.”

Sambrook prefaced this comment however with the insight that at least a few of the major reviews, including Unilever and J&J, are cyclical and decisions have to be made by 1 January, 2016, so these pitches have to take part now if they are to be on schedule.

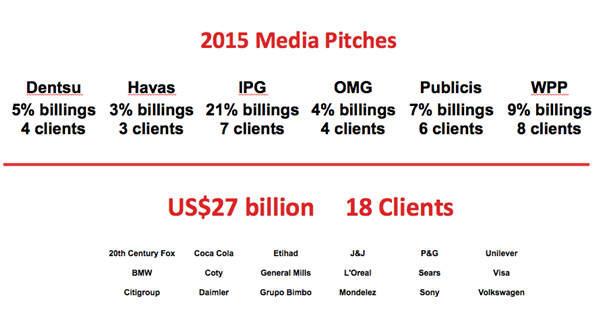

18 of the ongoing media pitches

Source: AdAge Data Centre

Reasons behind the pitches

Digital & programmatic

A point all consultant and agency sources have agreed on is that digital and programmatic are a major factor in most of the big pitches.

“The driving force behind all this is digital, both from a programmatic and rebate aspect,” said Greg Paull, principal at R3. “Every marketer can forecast their 2016 investment in these areas only increasing—and media agencies have far more variability in terms of offer, rates and service in these areas than they do in offline media.”

The industry is at an inflection point, said Waters. “Marketing and agency models were built in an analogue world and have transitioned into a digital world with varying degrees of success.”

“The the industry is having to deal with challenging new media planning & buying concepts such as paid/owned/earned, DSPs, real-time bidding, media rebates and content marketing to name a few,” agreed Richard Bleasdale managing partner of the Roth Observatory, Asia-Pacific.

Transparency is a concern when it comes to measuring digital media. “The big global advertisers are seriously looking at whether their digital media is dealt well within the existing agency arrangements,” said Sambrook. It has got to a point where many clients are considering taking digital in-house for full control over rights, data and spend.

This ties back to the MediaCom Australia controversy. “Marketers are less concerned about how agencies are making money in ways they don’t understand than they are about effectiveness. How much of the traffic bought online are seen by real humans are not robots?” commented a senior agency source based in North America.

The source added that many issues regarding digital measurement have yet to be resolved. “When you think how much of traffic measurement is based on the cookie when most are now viewing ads via mobile, the measurement is not there yet.”

Clients have also started questioning the ability of these incumbent agencies to deliver results in this environment. “Advertisers see it as imperative to be digital ready or equipped,” said Sambrook.

At least six sources spoken to in the course of researching this article agreed that quite a few clients have called the pitches to research new ideas, capabilities and technologies.

“In the past three to five years a lot has changed in the digital space and many advertisers are using this concern to go and explore the market to find the best fit solution now,” commented Darren Woolley, managing director of consultancy,Trinity P3.

Snowball effect

“P&G North America and Coca-Cola haven’t called a media pitch in around a decade,” pointed out an agency source. “P&G, especially, is a bellwether for the industry. Their pitch, combined with the media storm may have led some clients to call for a pitch out of nervousness or as an opportunity to negotiate for better rates.”

Philippe Dominois who heads new business for international media at Ebiquity believes likewise. “Clients are realising that if they’re not pitching, they may be losing out on the better deals. We haven’t seen the end of the pitch wave. This will carry on throughout the next six months and through the next year.”

Better rates

As with nearly every media pitch, clients are out to get more bang for their bucks. P&G has made no secret of its plans to slash agency fees by $500 million via consolidation.

“Procurement teams are constant under pressure to reduce fees,” said Paull. “Up to 70 per cent of those working in procurement are expected to reduce fees regularly.”

Several sources mentioned that quite a few clients regard pitches as a routine way of reducing costs. “Clients are under severe pressure by stakeholders to reduce spend in the face of a very challenging economic climate,” said an agency source.

Compliance obligations

Quite a few clients, said sources, have actually been delaying their pitch cycles because of the strong relationship they hold with the agencies. “Last year was low on pitches and they may have accumulated,” said one a regional agency lead.

One source raised the global media review that Samsung held last year as an example. “It was actually overdue but they were able to delay and hold off on their compliance-dictated cycle thanks to the strong relationships it held with its agency partners. But ultimately, you have to answer to shareholders and it makes sense to check every now and then that you have got the best partner.”

Conclusion

While it’s true that there have never been as many simultaneous global pitches as there are now, it would be simplistic to point to a single sensational root cause. The reasons the pitches are being held are varied and the large number stems from a confluence of these reasons.

Note: Several marketers were approached but have not responded to requests for comment. On the agency side, Starcom, ZenithOptimedia and IPG Mediabrands were also unavailable or unable to comment on the issue.

Source: Campaign Asia-Pacific