Total advertising revenue growth in China is expected to reach 8.2% in 2023, with digital outpacing all other media formats, growing 15.5% year-on-year, according to R3’s 2024 China Media Inflation Trends report. According to the global independent marketing consultancy, this marks a recovery from the previous year as China’s economy stabilizes in response to adjustments in pandemic policies, and points to a future media landscape dominated by digital display advertising and OOH.

“After the challenges of the past two years, China’s media landscape is showing a clear trend towards app-based and OOH advertising,” says Sabrina Li, Managing Director at R3 China.

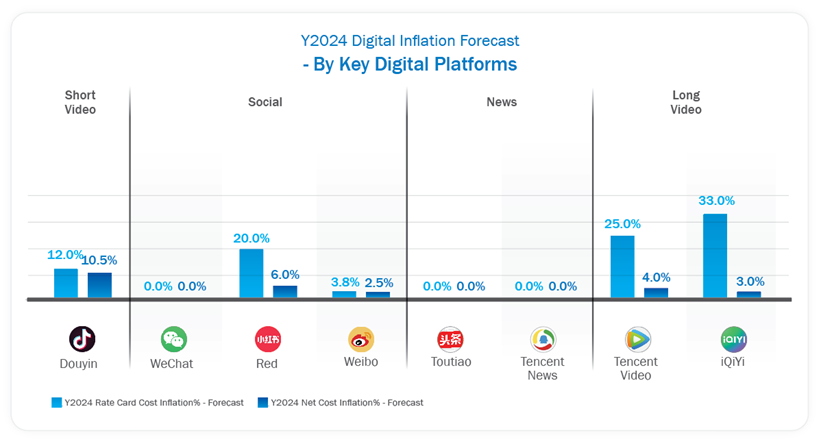

With the exception of Weibo, all digital giants and key digital platforms experienced double digit growth in 2022/2023. “Audience targeting is becoming more precise,” says Li. “Apps are segmenting into defined interests while delivering end-to-end education, entertainment, and commerce offerings, driving demand with marketers.”

Video Platforms Lead on Media Inflation

Baidu’s iQIYI is expected to surpass Tencent in its rate card prices by 8% in 2024. The video platform has continued to increase in revenue and membership services growth, and the trajectory of its media pricing going forward will largely be determined by the popularity and quality of its content.

“Content is a key differentiator for video platforms in terms of engagement and media pricing,” says Li. “Good programming can lead to a surge of app downloads, as we saw with shows such The Knockout, which drove downloads of iQIYI to surpass WeChat and Douyin.”

Xiaohongshu (Red Book) is expected to increase its rate cards by 20% in 2024, leading demand against social apps in China. The fashion and luxury platform is already China’s fourth biggest online seller and has enjoyed immense popularity; forecasted to have more users in 2025 than the super app WeChat (eMarketer, Oct 2023).

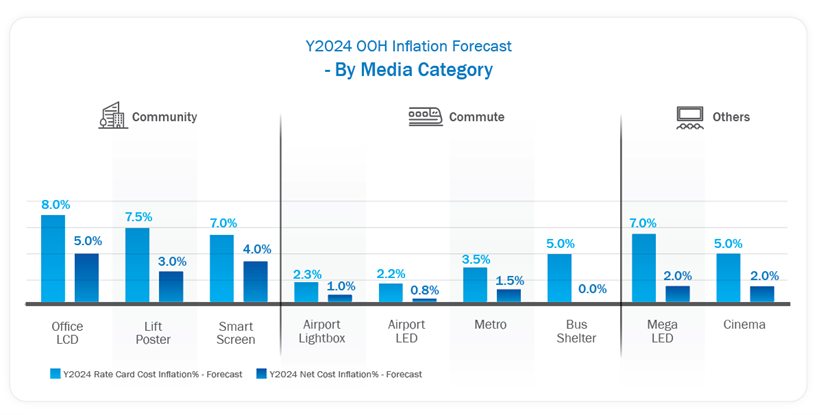

OOH Prices Leap Forward

Work resumption across China has resulted in increased inflation in OOH media within urban areas, though growth in airport media remains subdued. Office LCDs, Lift Posters, Smart Screens, and Mega LEDs is expected to experience a 7-8% inflation rate in 2024, with Metro and Bus Shelter media forecasted to increase 3.5% and 5.5% year-on-year.