R3, an independent consulting firm, assessed 489 M&A deals in the marketing services industry in the period of January to December 2019, with $27.7bn invested overall. This marks a 15% decrease in spend on the previous year.

“Buyers have been looking at investments that will strengthen their position in an uncertain geopolitical climate,” said Greg Paull, principal at R3. “Though martech and adtech have driven M&A value, there has been more interest in acquisitions that will increase regional presence and serviceability.”

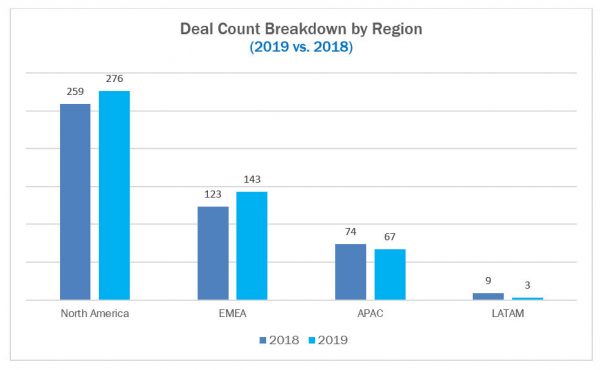

North America led M&A value ($19.9bn) by region and volume, while trade tensions and increased regulatory scrutiny continued to negatively impact the appetite for outbound investment in China and Asia Pacific.

HOLDING COMPANIES PULL BACK ON M&A

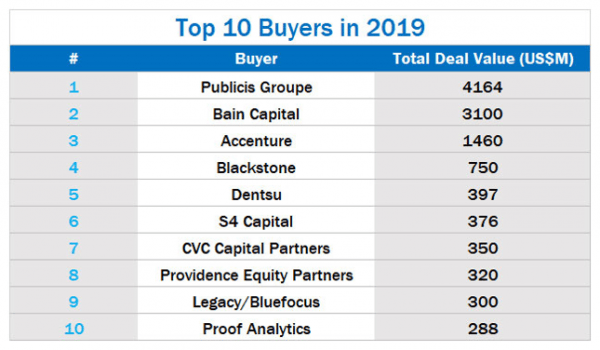

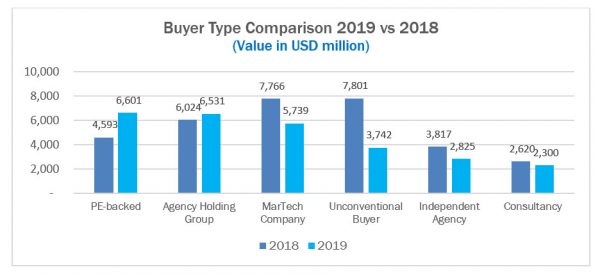

Holding companies pulled back on quantity, cutting the number of M&A deals by more than half though year-on-year spend remained constant. Publicis Groupe was the top buyer after dramatic M&A activity in 2019, with Dentsu leading holding groups in total number of transactions (12). Amongst traditional holding companies, only Publicis ranked in the top ten acquirers, the first time so few have appeared in this list

“Restructuring has shifted attention away from volume and forced holding companies to attend to integration,” said Paull. “It’s been about what’s going to help win new business.”

PRIVATE EQUITY INCREASES M&A COUNT AND VALUE

Private equity groups contributed 44% more in deal value globally ($6.6bn), with Bain Capital and Blackstone making two of the top five deals in 2019. Holding companies followed close behind, though even with Publicis Groupe’s purchase of Epsilon, value of acquisitions only clocked an 8% increase from the previous year.

“The ‘buy and build’ strategy of cash-rich PE-backed agencies over the past few years has kept the M&A landscape buzzing,” Paull said. “We expect to see continued PE investment in marketing services in the new year, though transactions are likely to be more modest.”

Martech companies were the most active buyers, increasing the number of deals made by 68% as they look to expand their capability into areas like analytics, email and search.

M&A DEALS START TO SPREAD ACROSS CATEGORIES

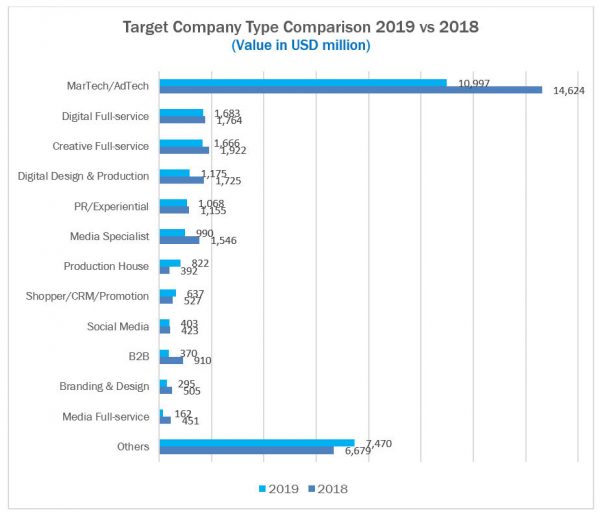

Though buyers favored martech and adtech companies in 2019, diversity was notably present in the type of acquisitions made. Experiencing the most growth were production houses and shopper/CRM/promotion companies, which saw double-digit upticks in both number of transactions and value.

“More clients are looking for enterprise-wide transformation and this is leading buyers to balance their portfolios,” said Paull. The top 10 deals in 2019 included data and research (Kantar, JD Power), retail and customer experience (Triad, Rightpoint) and CEO consulting (Teneo).

OUTBOUND DEALS PLUMMET AS INVESTORS FOCUS CLOSER TO HOME

North America led M&A activity globally as trade uncertainty and growing protectionism limited interest in outbound transactions. The number of deals made in North America increased in 2019 by 7%, followed by EMEA which experienced year-on-year growth in both volume and value despite speculation around the impact of Brexit.

China’s M&A landscape experienced its weakest year in the past decade, with deal activity in marketing services decreasing by 54%. The biggest domestic deals reflect the strength of radio and OOH locally and expectations of a growing automotive market.

The number of deals in APAC slipped by 9%, with value decreasing further by 55%. “Investment in APAC has slowed though it remains of interest to buyers wanting to address marketplace complexity in the region,” said Paull.