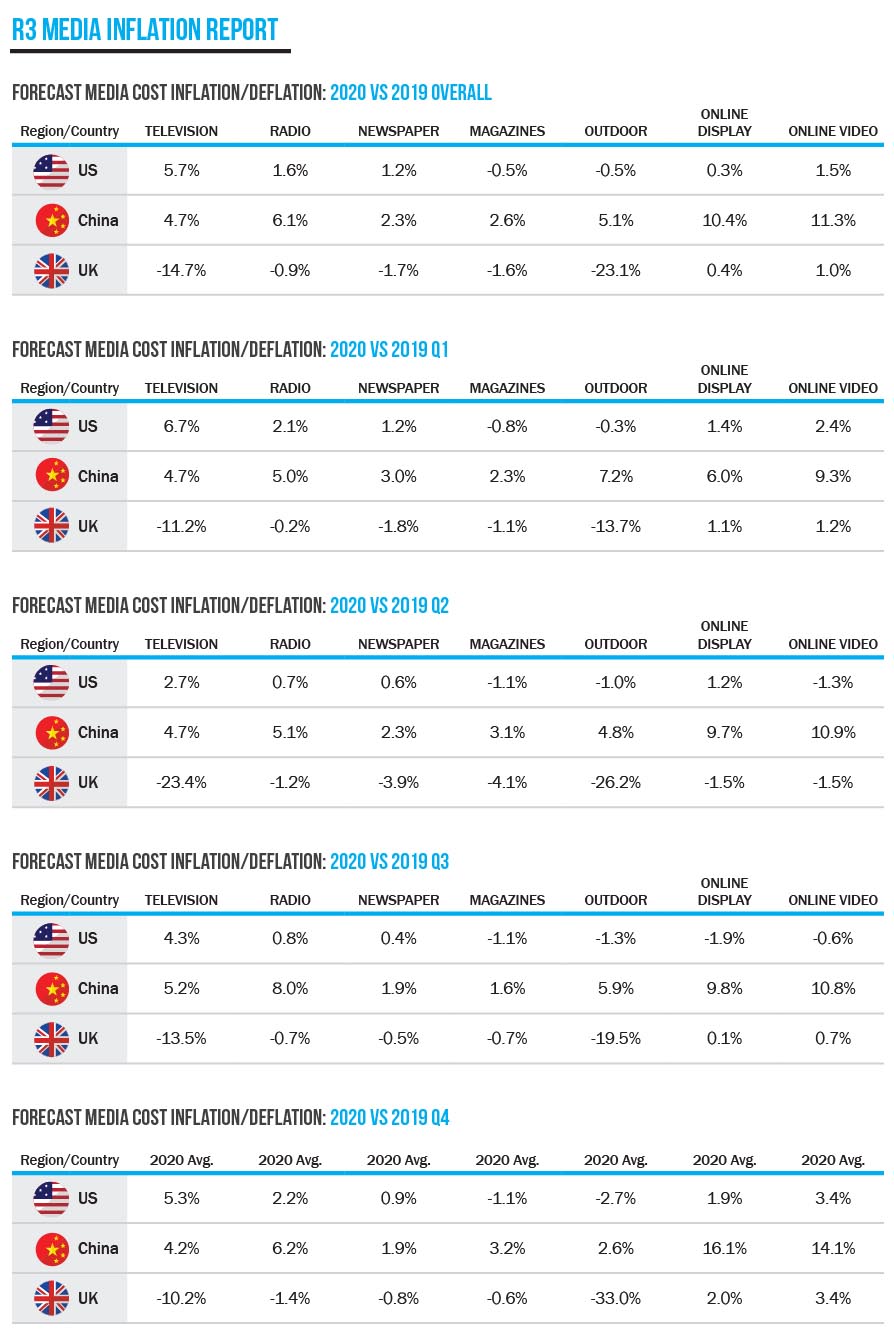

Global media inflation is expected to hold at +3.3% for 2020 according to a new study led by independent marketing consultancy, R3. US media inflation rates remain in line with the global average at 2.7%, while markets where new reported coronavirus cases have affected re-opening schedules, like the UK, Australia and Italy, have been hit hardest.

For this study, R3 reached out to five of the six largest agency holding groups as well as tapping into industry data from media owners and analysts. The final report covers 23 countries from North America, Europe, Asia Pacific, Latin America and Africa, across more than seven media types. In total, more than 3,000 data points were covered to derive the final overall number.

Big changes by quarter

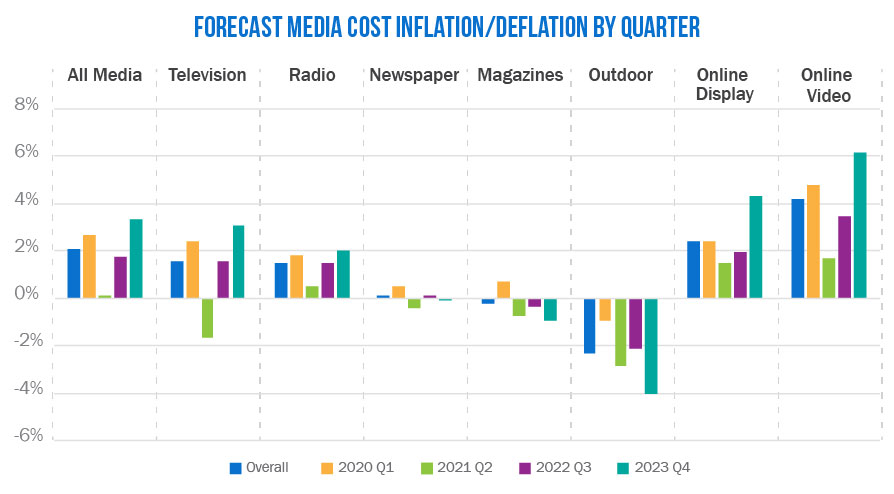

R3 collected data by quarter for the first time in anticipation of dynamic changes resulting from COVID-19, and alarming variances have emerged, particularly in Q2 when most of the countries surveyed were under lockdown.

“It’s the first time in media history that viewership and engagement has gone up without the same growth potential in inventory and pricing,” said Greg Paull, Principal of R3. “COVID-19 has created a very unique challenge for media owners and a very unique opportunity for the boldest of advertisers” he added.

Print and outdoor will experience deflation in most markets as people stay at home. As the first country to come out of lockdown, China’s media market remains stable and buoyant as mobility resumed in Q1 and people have returned to commuting. The UK can expect further deflation in its already depressed outdoor market in Q4 as worsening weather and gathering restrictions keep people indoors.

Broadcasters in Europe face plummeting prices

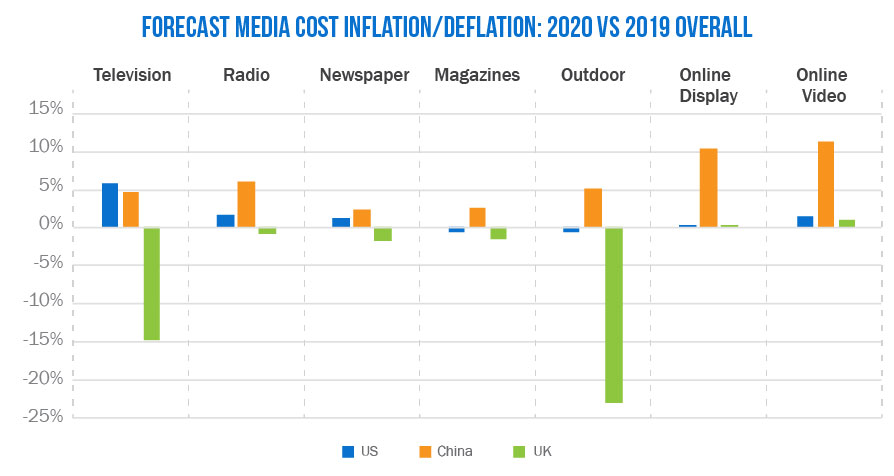

A reduction in demand in inventory as marketers shelve or decrease ad spend sees UK television advertising prices drop by an average 14.7% in 2020, only to be outdone by outdoor advertising which will see deflation as much as 23%. In US, media inflation rates for television advertising remain stable at 5.7%.

Asia tells a different story with higher prices expected for television media in markets like Indonesia, Thailand, and India where people remain dependent on broadcasters for news.

“Broadcasters without alternative revenue streams are going to be particularly vulnerable,” says Paull. “In Asia, top advertisers tend to represent essential services like food and telecommunications, while in Europe, high-spending categories like travel and sports have seen their revenue fall deep into the red.”

Online display faces challenges

Global uptake of gaming and streaming video will see buyers paying more as online video will face high demand. Media buyers in China will be experiencing inflation on online video of as much as 11.3%, compared to the US where inflation with stay around 1.5%.

Online display will not experience as much price increase as online video as the medium faces challenges related to brand safety during COVID-19. Brands and platforms have added terms related to the pandemic to keyword blocklists, impacting the revenues of news publishers.

“As more marketers look to spend money programmatically on ad-supported streaming platforms, we’ll see a pressing need to ensure that the ads online are measurable, safe and not affected by fraud,” says Paull.