Digital mobile media and OTT will lead China’s media inflation rates in Y2020 thanks to the continued popularity of streaming services and wider access to 5G connectivity, according to a report by independent consulting firm, R3. A slowing media market is expected to have a negative impact on media inflation rates in the coming year, though advertisers will be buoyed by plans by the Chinese government to reduce interest rates to stoke consumer spending.

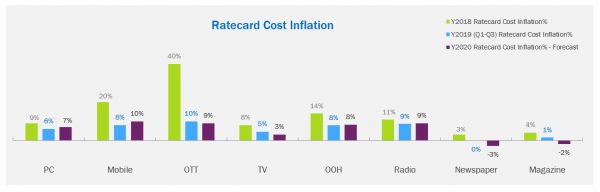

“Rate cards for mobile media, OTT, OOH and radio will cap at 10% next year, despite the media market slowing to 2.8% in 2019, a decrease on both Y2018 and Y2017,” said Sabrina Lee, Managing Director at R3 China. “With 99.1% of all China’s netizens connected through mobile phones, digital will dominate advertiser investment.”

Print suffers negative media inflation rates as social and online rises

Traditional media continued its downward trend, with newspapers taking the biggest hit with -30.6% growth in media investment in 2019 1H. Dwindling readership has resulted in publishers facing permanent shutdowns and content overhauls, further making print unfavorable with advertisers. This will cause newspapers and magazines to suffer a negative drop in media inflation rates in Y2020.

Loyal television audiences are helping national television networks maintain single-digit growth, though overall television performance has been flat. Media inflation will decrease to 3% in Y2020, making it the lowest across PC, Mobile, OTT, OOH and Radio.

Only Mobile media inflation rates will experience an increase in the coming year. OOH and Radio will remain stable.

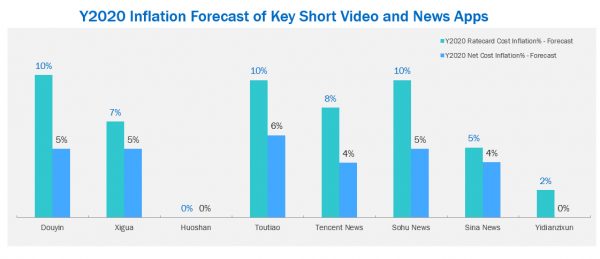

Short video apps and news feeds drive inflation increase

All short video apps and news feeds will see up to a 10% increase in media inflation in Y2020 as such platforms become a staple for advertisers. Digital media accounted for more than 60% of advertisers’ media spend in Y2019, with 80% of that allocated to Baidu, Alibaba Group, Tencent and ByteDance.

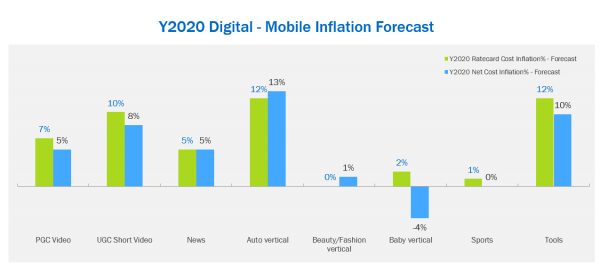

Automotive verticals post growth in both PC and mobile

As China’s car industry is expected to continue its slowdown into 2020, demand for advertising in automotive verticals will drive inflation media rates up 1% across PC and mobile. Media inflation in beauty verticals will see no change on PC, but advertisers can expect a slight increase on mobile. Notably, media inflation rates in the baby vertical will see a 6% decrease into the negative on mobile, and a 3% decrease on PC.

5G connectivity and urban travel sees radio inflation rates increase

The inflation of radio and OOH media will increase in Tier 1, Tier 2 and Tier 3 cities as commuters embrace China’s large subway networks. This year, Beijing introduced 5G connectivity across its entire subway line, which will encourage people to consume more online mobile media during their travels.

The increase in Radio media inflation rates in Y2020 can also be attributed to time on the road, particularly in Tier 2 markets like Chengdu and Xiamen, where the increase is as high as 13%. Though China has more than 3,000 radio stations, radio audiences have started exploring audio entertainment on other digital platforms.