Credit: PeopleImages/iStock

Publishers acquiring agencies was perhaps the biggest trend to come out of 2016, according to global marketing consultancy R3’s annual M&A report, which specifically looks at deals made in the marketing sector.

Yue Tang, Consultant

“Publishers are looking at different ways to extend their revenue stream,” said Yue Tang, consultant at R3. “And we see this trend continuing. This year we saw a lot of publishers struggling with generating revenue. But if you’re a good publisher you service both your audience and also your advertisers. Those who can combine the two the best are the ones who are going to survive.”

The New York Times purchased martech outfit HelloSociety for $21 million and design agency Fake Love for $11 million, R3 said. The Financial Times snagged Alpha Grid, a content marketing studio, for $7 million. Time Inc. and Vice also made acquisitions totaling $50 million.

Although the dollar amounts might appear small when compared with the Dentsu’s and WPP’s of the world, publishers purchasing marketing service agencies was essentially nonexistent in 2015, R3 said.

Acquisitions made by tech companies like Google and Snapchat can be viewed as more publisher-like, too, Ms. Tang said. “Google and Snapchat are tech firms, but they are buying other tech firms that will help them with content generation,” she said.

Google purchased FameBit, which connects brands and influencers, for $36 million. Snapchat acquired digital creative company Flite for $42 million, R3 said. Both Google and Snapchat create content and have made moves to better deliver services to advertisers.

Overall, mergers and acquisitions targeting digital agencies, ad-tech companies and analytics firms skyrocketed for the 2016 calendar year, R3 said.

The marketing industry saw 398 M&A deals last year, totaling an estimated $14 billion, up from 153 deals valued at $5.6 billion in 2015.

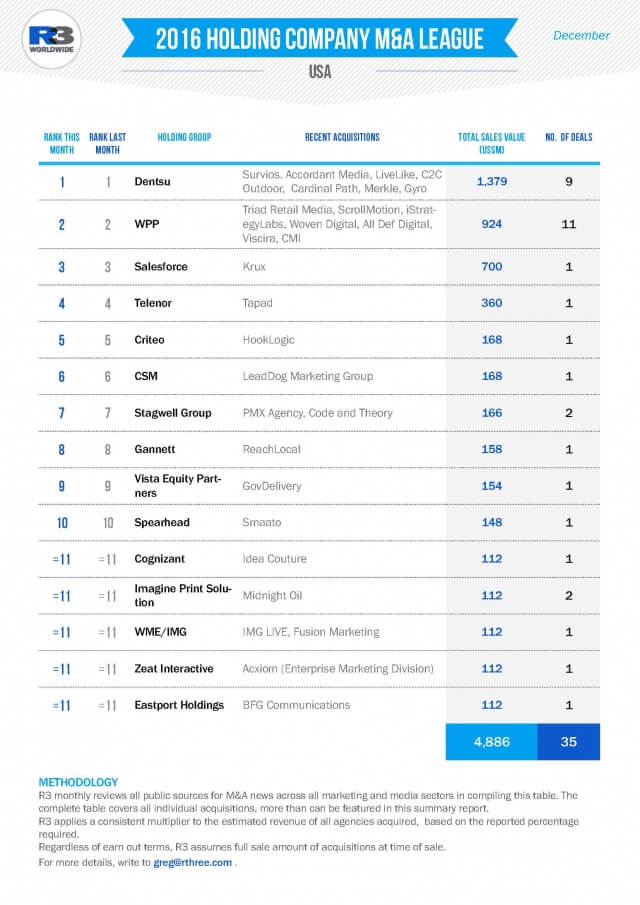

The marketing sector was a watershed year for acquisitions, with traditional players fighting with private equity, consulting, IT firms and Chinese conglomerates, according to R3. The six global holding groups represented 22% of all transactions, with Japan’s Dentsu moving up a spot to No. 1 in 2016. The company bought one of the largest independent agencies, Merkle, for $979 million, helping it bring significant data and analytics to its offerings, R3 said.

Dentsu made 39 deals totaling $1.9 billion in 2016. No. 2 WPP made 36 deals worth $1.15 billion, R3 said. Salesforce, which came in third, made one deal with its purchase of data management platform Krux for $700 million.

Meanwhile, 2016 might have been the year that the consulting firms got serious about expanding into marketing communications, as consultancies spent a total of $477 million buying such companies, up 234% from the previous year.

IBM invested more than $240 million into Resource Ammirati, Aperto and ecx.io. Accenture spent $232 million acquiring companies like Karmarama, Mobgen and IMJ. And Deloitte invested into boutique agency, Heat.

Greg Paull, Principal & Co-Founder

“The consultant firms have recognized that while they have the business processes, they are often lacking the best creative talent to drive breakthrough thinking,” Greg Paull, R3 co-founder and principal, told Ad Age. “They will prove the most natural threat to the traditional path of the CMO through a holding group.”

Source: AdAge