Last year’s unprecedented string of Mediapalooza agency reviews involving some of the world’s biggest advertisers (Coca-Cola, Walmart, P&G, etc.) was not an aberration. According to a new report released by top global consulting firm R3, it was a signal of the new normal on both the media and creative sides of the advertising business.

“Everyone thought that things would slow down, but it seems that’s not really the case,” R3 principal and co-founder Greg Paull told Adweek. “There have been just as many media reviews this year.”

The consultancy’s Global New Business Rankings for the first half of 2016 recorded a 6 percent increase in overall account activity via data drawn from 3,700 new business wins covering more than $1.2 billion in revenue across creative, media and digital agencies worldwide.

Holding Company Trends: A Winning Streak for Omnicom

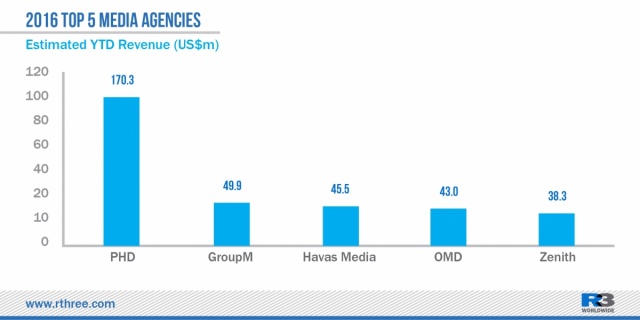

The report finds Omnicom in a particularly strong position. This is largely thanks to the performances of its media agency PHD, which won the $3 billion Volkswagen account in June, and its newly launched Hearts & Science unit, which also won P&G to push the holding company’s new business revenue up by 85 percent in the first six months of 2016. AT&T’s decision to consolidate its $2 billion business with Hearts & Science and BBDO earlier this month reinforces that narrative.

“WPP has been in first place because they have so many agencies and so many media accounts,” Paull said. “But maybe, because of big losses like Volkswagen and LG, they have dropped behind Omnicom and Dentsu.”

“Publicis Groupe has done OK” this year, Paull said, adding, “The challenge is that Starcom and Zenith have to resurrect themselves” following the losses of Walmart, P&G and Coca-Cola.

Creative Agency Trends: Reviews Are Up and Revenues Are Down

According to Paull, the long-rumored “death” of the creative agency of record model is proceeding apace as clients look to build more diverse rosters of small and mid-size shops. He sees pharma giant GSK’s recent “consolidation” with nine agencies across four holding companies as a sign of things to come, telling Adweek, “You’re going to see more of that and fewer of these BBDO AT&T-style wins.”

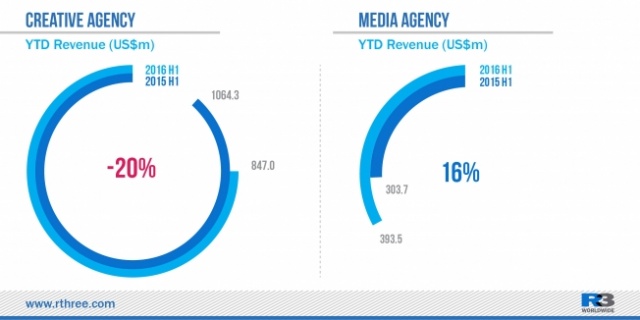

“Reviews are up and revenues are down for creative agencies,” he said. “The basic topline: more are circling for less and less business. It’s proving to be a challenge for these large agencies of record as more clients look to build a roster. They want that flexibility, because they’re under a lot of pressure to deliver … the days of the agency of record are in question.”

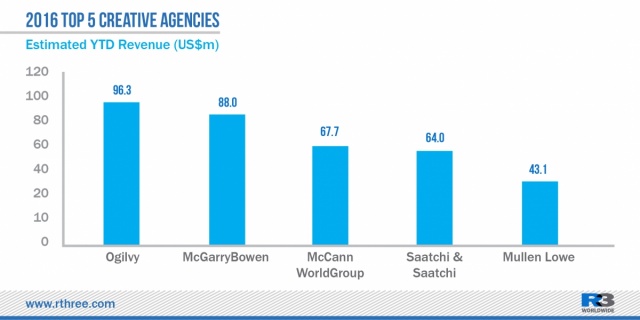

WPP’s Ogilvy led the way among agency networks in terms of revenue after winning Network of the Year at this year’s Cannes Lions festival. “They’re not number one in the U.S. by any means, but it’s about diversity of markets,” Paull said, attributing much of the network’s recent gains to disparate units like OgilvyOne and Geometry Global. Noting a string of small and mid-size account wins across the globe, he added, “There are so many dots on the map and so many ways to expand client relationships.”

The full list of top U.S. agencies also ranks names like mcgarrybowen, GSD&M and VML ahead of trendier shops like Droga5. Paull attributes this ranking to under-the-radar new business and points to VML’s recent Wendy’s win, adding, “It reflects the nature of marketers really seeking out fresh solutions.”

Media Agency Trends: More Reviews Ahead

“It’s different for media agencies, where overall revenue is actually up by 16 percent,” Paull said. “The ask for such an agency is different than it was 3 to 5 years ago … the diversity of offerings has expanded quite a bit.”

He continued, “We manage a lot of these pitches, and it often comes down to people and talent in terms of having the right people at the right time. It’s no longer just about core ideas or media strategy.”

Paull sees the major holding companies spending more money on the digital and data sides of the business in coming months and years, noting both Dentsu’s acquisition of performance marketing company Merkle and Sir Martin Sorrell’s recent rant against “the snottiness of believing that creativity just resides in the creative department of traditional agencies.”

“Sorrell has invested heavily in research, which is not terribly profitable, but he’s taking the lead in terms of diversification,” Paull said. “Two-thirds of his business will come from data and digital in the coming years.”

A Forecast for the Next Six Months

R3’s research indicates no slowdown in the Mediapalooza trend, and Paull believes that the recent string of reviews stems, in large part, from a newfound reliance on content. “Marketers can’t rest on their laurels,” he told Adweek. “They have to look for new ideas.”

Despite the fact that creative agencies are losing revenue on the whole, Paull still thinks that big ideas will win the day.

“Agencies like Droga5, BBH and Anomaly are relatively small, but they brought in big wins this year,” he said, predicting more reviews in the months to come as clients expand their agency rosters in the interest of reaching an increasingly overstimulated consumer base.

“You’re in this content-rich environment where people want hundreds of messages per year as opposed to two or three great creative agencies on the forefront.”

Source: Adweek