Marketers Reviewing Media Biz Now Outnumber Shops With Resources to Compete

When one of the biggest media agencies in the world pulls out of the pitch for Coca-Cola’s business, you know the storm of simultaneous reviews is taking a toll.

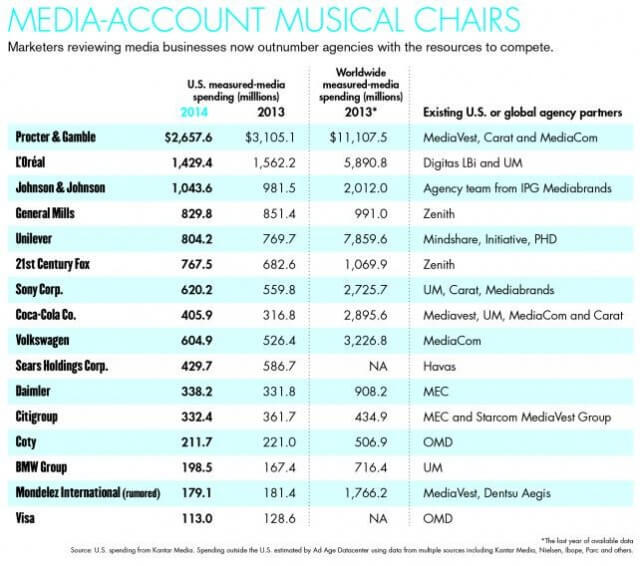

Since Ad Age’s report just two weeks ago on the surge in media review activity, the list of top accounts in play has only grown, adding megamarketers General Mills, 21st Century Fox, Johnson & Johnson, Sony and Volkswagen.

“I don’t think this is a normal cycle,” Dentsu Aegis U.S. CEO Rob Horler said. “It is unprecedented; I’ve never seen anything like it.”

Marketers reviewing their media businesses now outnumber the agencies with resources to compete in the reviews. Despite a winning record of late, Dentsu Aegis’ Carat is not proceeding with the Coca-Cola review, according to people familiar with the matter. (Carat declined to comment.) And other large global shops with similar winning records are assessing what they can handle.

“Agencies are faced with a choice, an abundance of choice, and as a result, they may decline what previously could have been exciting opportunities,” said search consultant Joanne Davis. “We’ve seen some of that happen.”

The glut of media reviews that was originally deemed largely cyclical is now undeniably linked to marketers’ desire for change, as well as the quest for more transparency from agencies following fresh allegations that U.S. shops let undisclosed rebates influence their work.

Greg Paull, Principal of R3

“I would say two-thirds of these pitches are being fueled by the rebate debate,” said Greg Paull, CEO of marketing consultancy R3, in an email. “Marketers are being asked by their senior management to shift more funds to digital, and that’s the area with the most-variable deals.”

Transparency is a factor in some way for all the reviews that marketing consultancy MediaLink is supporting, according to Lesley Klein, senior VP at the firm. For one client, she said, “We’re actually issuing a contract with the RFP that will detail all the expectations the client has in terms of rebates from the agency.” Another client’s request for more transparency has led to contract renegotiations with its agency, covering areas including rebates, the underlying costs of online inventory and compensation, she added.

“An unprecedented number of major media agency accounts have gone up for review since much of the industry became aware of practices related to undisclosed agency compensation,” wrote Pivotal Research Senior Analyst Brian Wieser in a note to investors. “The scale of these reviews reinforces our view on the sector and recommendation that investors exit it or stay on the sidelines for now.”

Clients’ motivation is not just savings, according to Ms. Davis, whose firm is supporting the General Mills review. “It’s effectiveness in a new marketing ecosystem,” she said.

Marketers are looking for partners that can help clients figure out how to meet aggressive digital-spending targets over the next few years as the role of ad-tech grows and complexity increases, said Mr. Horler. Some of those targets — shifting dollars to digital from traditional media, for example, or buying more media programmatically — have been spelled out explicitly in the briefs. Marketers that already spend 10% of their budgets on digital media or digital programmatic might be looking to reach 20% or 30%. If it’s 50%, the goal might be 100%.

More marketers are putting specific targets out there partly to get their own organizations to wrap their heads around the very big shifts that need to happen, said Marla Kaplowitz, North American CEO of WPP’s MEC. “No one can remember a time like this,” she said. “There are tremendous cost pressures on companies and procurement departments. There’s also the opportunity to assess what’s happening from a media standpoint.”

Marketers also need to more effectively target across converging digital channels, particularly mobile, social and e-commerce, Mr. Horler said. “They’re doing it because they’re under so much pressure to have all the right answers,” he said of the reviews.

The changes are leading to common themes across a number of today’s requests for information, with clients asking how to structure internal teams to best work with agency teams.

Clients are saying, “‘We realize that’s a huge leap of faith and a huge journey we’re going to go on,'” Mr. Horler said, “‘and explain to us how you’re going to help us get there more quickly.'”

Source: Ad Age