R3’s Greg Paull explores the reasons behind the unprecedented number of media reviews in progress—and tallies the results thus far.

Greg Paull, Principal and Co-founder of R3

It’s a name that could only have come from America, as did most of the reviews it refers to: the ‘Mediapalooza’, the unprecedented 21 pitches that kicked off through this summer, ruining many a media agency executive’s holiday plans (and some consultants too).

With many of the world’s largest advertisers involved—P&G, L’Oreal, Unilever, Volkswagen, Coca-Cola and others—it has become the touchstone of 2015’s shift in the role media agencies are being asked to fulfil for marketers.

The reasons for all this are just as diverse than the number of reviews, but it’s our analysis that digital is the primary driver, both in terms of upstream and back office.

Many marketers ‘inherited’ their media agencies when their digital spends were below 20 per cent and social and analytics was just something on the horizon. So taking time now to thoroughly review the options to find the best possible strategic partner makes sense. From a back-office perspective, there’s never been more pressure than now for the media agencies and their holding companies to be more transparent on AVBs (agency volume bonuses)—amounts accrued from media owners based on investment. In the US, the ANA (Association of National Advertisers) has kicked off an independent audit of just this practice. These 21 reviews will all have commitments to these front and centre.

So who’s in front so far?

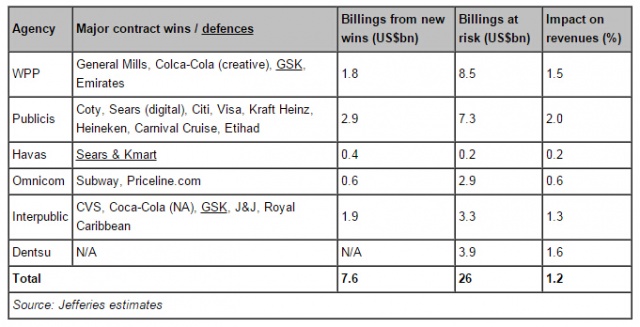

Based on global data by leading analyst Jefferies (below), Publicis Groupe has so far captured 38 per cent of the total billings for this group of marketers, while also losing Coca-Cola in the US to IPG.

Amongst some of the bigger wins, the holding group* has grabbed the global Citibank business from MEC and the prestigious Visa business from OMD. The Omnicom agency had an extremely long history with the payments company, and this is the first agency Visa has appointed outside of the holding company in the last five years.

WPP, for all its scale and strength, is yet to bring in a huge fish. Still, with P&G, L’Oreal and Unilever still in play, there’s more than enough opportunity to do this.

Closer to home in Asia Pacific, Carat continues to lead the way in our New Business League through August. Starcom moves up to second spot on the back of the BMW China win (out of Carat), a review that took no less than 13 months, causing challenges to all agencies involved. OMD also relinquished a spot in the top three to sister agency PHD, once the Asia-Pacific portion of the Visa loss was accrued.

As we’ve mentioned before, the bigger issue for 2016 will not be for the 21 marketers and their shiny new agency agreements, but the ones “left behind”. Media agencies and vendors are unable to offer world’s best pricing and talent to everyone; for those companies that didn’t pitch their media in 2015, locking down commitments and rates for the year ahead will be a major issue.

We suspect it may not be long before we are talking about “Mediapalooza 2”. Let’s hope this one is better than most of the sequels out of Hollywood.