R3 released a report on new account revenue for the first half of 2018

It’s been a bumper year for new business revenue.

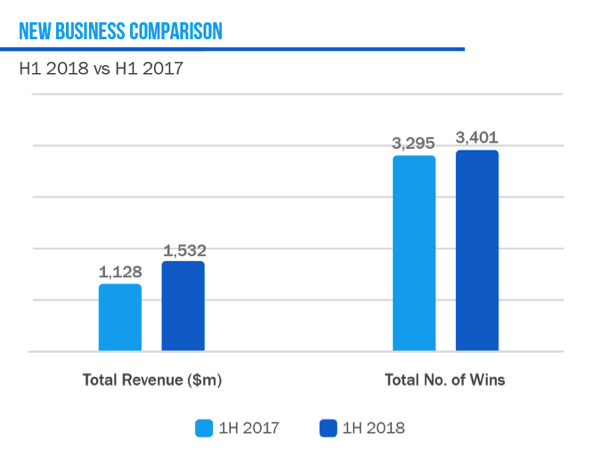

According to a report by international consultancy R3, new business revenue is up 36 percent. The report tallied an increase from $691 million in the first half of 2017 to $1.09 billion in the first half of this year due to a total of 3,401 agency new business wins from over 700 agencies globally, according to R3, up three percent from the first half of 2017.

“2018 has been a big year for creative wins globally—which are up 57 percent with some big alignments from Nestle, P&G and others,” R3 principal and co-founder Greg Paull said in a statement.

Creative new business revenue saw an increase of 57 percent, with a 5 percent increase in total new business wins. This was largely driven by activity in the U.S., where revenue for new creative wins is up 88 percent compared to the same period in 2017, with Saatchi & Saatchi’s win of P&G’s fabric care account leading the way.

“The number of reviews in the U.S. comes back to marketers continuing their search for stronger content and transparency,” Paull explained. “Marketers are struggling to find great content that will break through—and are moving in larger numbers than ever to find new partners. On the media side, we’re seeing a ‘second wave’ of reviews since the release of the ANA transparency report that are looking for more transparent partners.”

For media, new business revenue was up 11 percent, with total new business wins up just 0.3 percent. In the U.S., new business revenue for media was up 70 percent compared to the first half of 2017.

“For media, it’s really about transparency. It’s not just about rebates anymore, marketers have to worry about everything from programmatic transparency to influencer fraud, and they are looking for partners that can help them in this,” Paull told Adweek. “This isn’t necessarily a global trend, however. While media new business revenue is up 70 percent in the U.S., it’s actually down 17 percent in APAC, where there was a flurry of activity last year and not as much concern over transparency.”

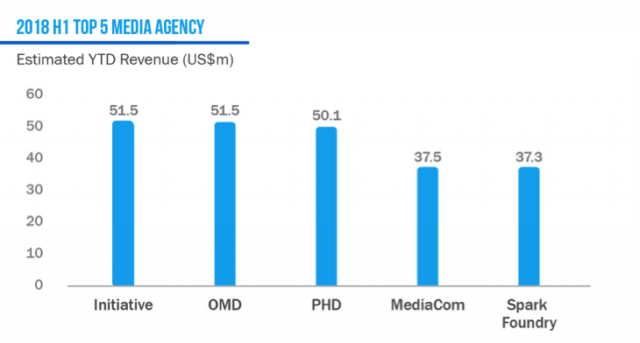

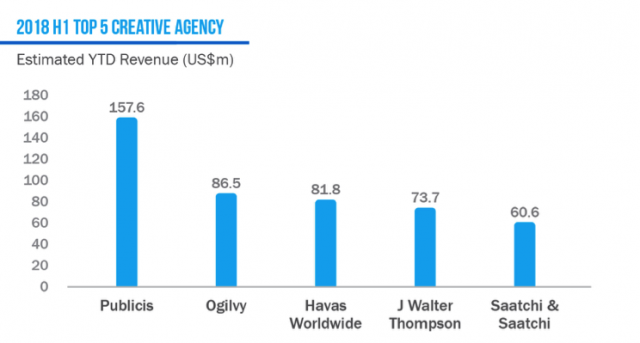

Initiative and OMD were deadlocked for the top media agency position for the first half of 2018, followed by PHD, Mediacom and Spark Foundry. On the creative side, Publicis came out well ahead of the competition, followed by Ogilvy, Havas Worldwide, JWT and Saatchi & Saatchi.

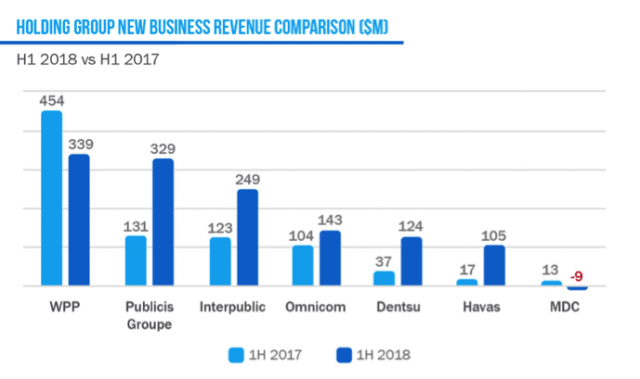

WPP maintained its top position for both new business wins and new business revenue, despite a significant decrease in both categories, including a decline from $454 million to $339 million in new business revenue. Creative agencies Ogilvy and JWT were both among the top five for new business revenue.

Publicis Groupe saw an increase in new business revenue from $131 million to $329 million and a relatively steady number of new business wins total, largely thanks to Saatchi & Saatchi’s P&G’s fabric care North America and Campbell’s Soup global accounts, as well as Publicis picking up Mercedes-Benz’s global creative account.

IPG saw an increase from $123 million to $249 million, despite a decrease in overall number of wins from 567 to 371. This was largely thanks to Initiative’s win of the global Revlon account and MullenLowe winning global duties for Edgewell Personal Care.

“Some surprising leaders came to the forefront,” Paull told Adweek, “with Initiative leading the way for media and Publicis for creative. Both of their holding companies actually had less wins in terms of overall number from H1 2017 to H1 2018, but they both saw significant spikes in new business revenue.”

Paull said he anticipated new business trends to continue “through the end of 2018 and beyond as marketers are examining their entire agency models in the wake of digital transformation. Particularly as more players like ad-tech firms, consultancies and even publishers are encroaching on agency territory, marketers are reevaluating the the way their approach partnerships.”