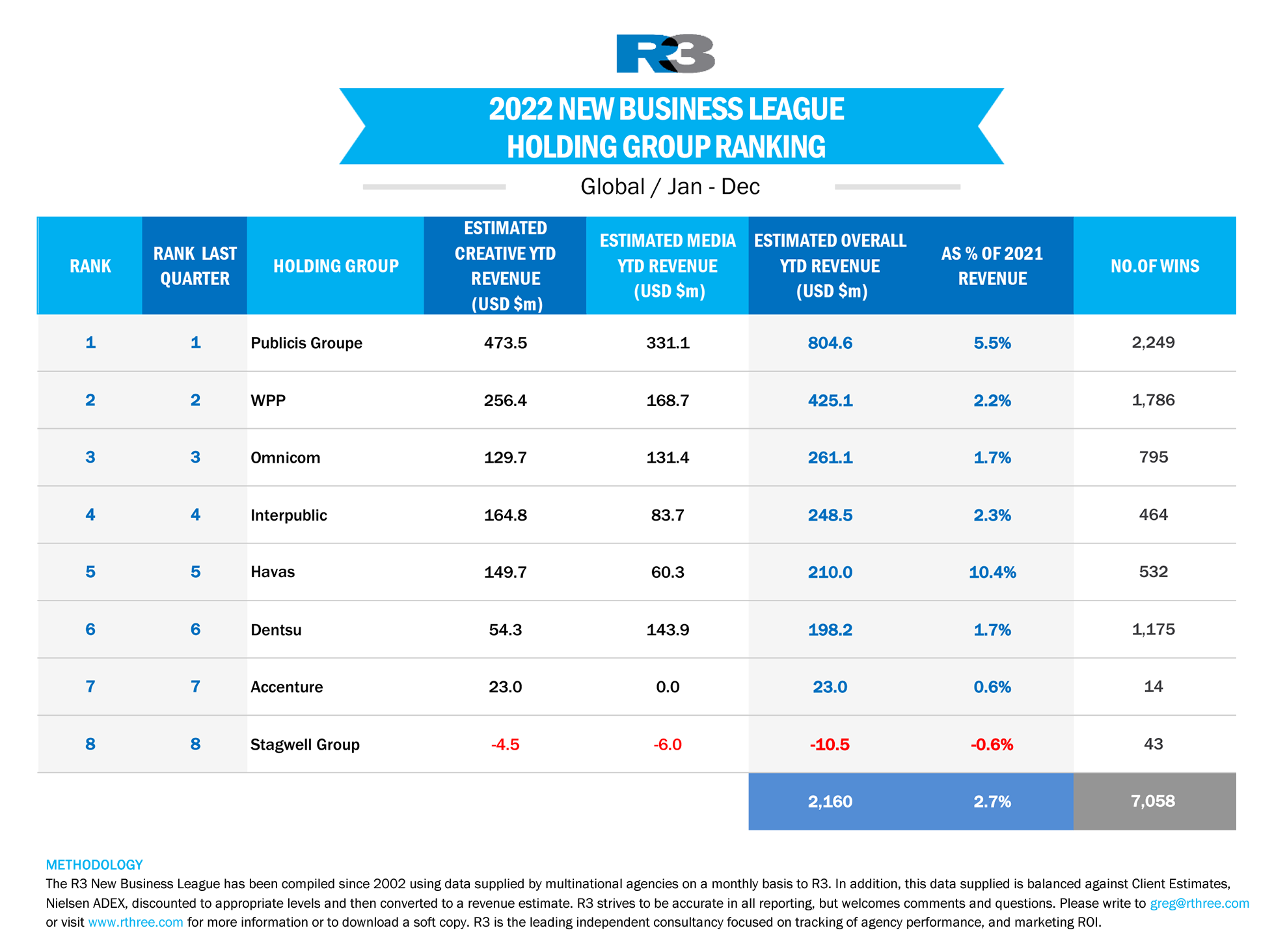

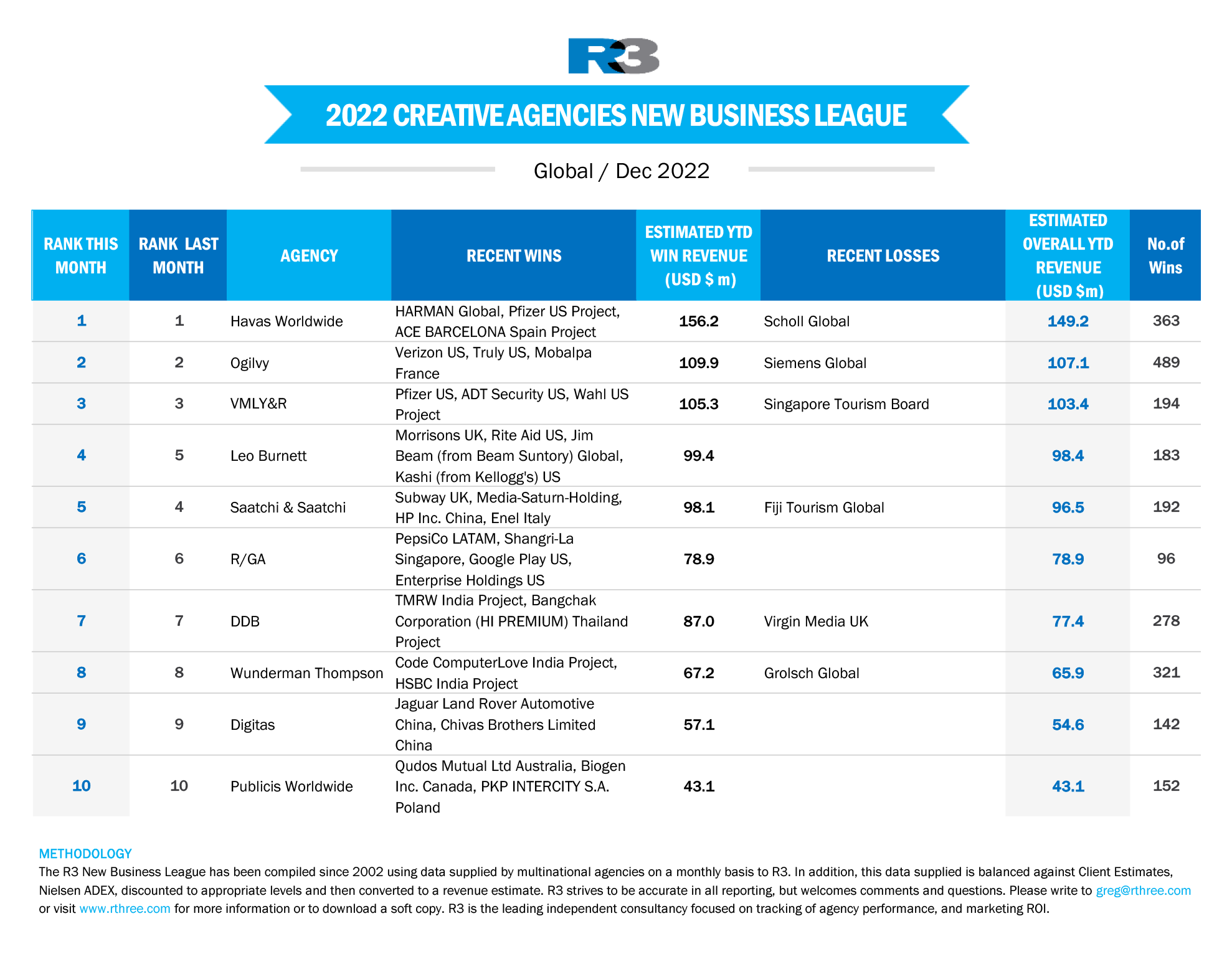

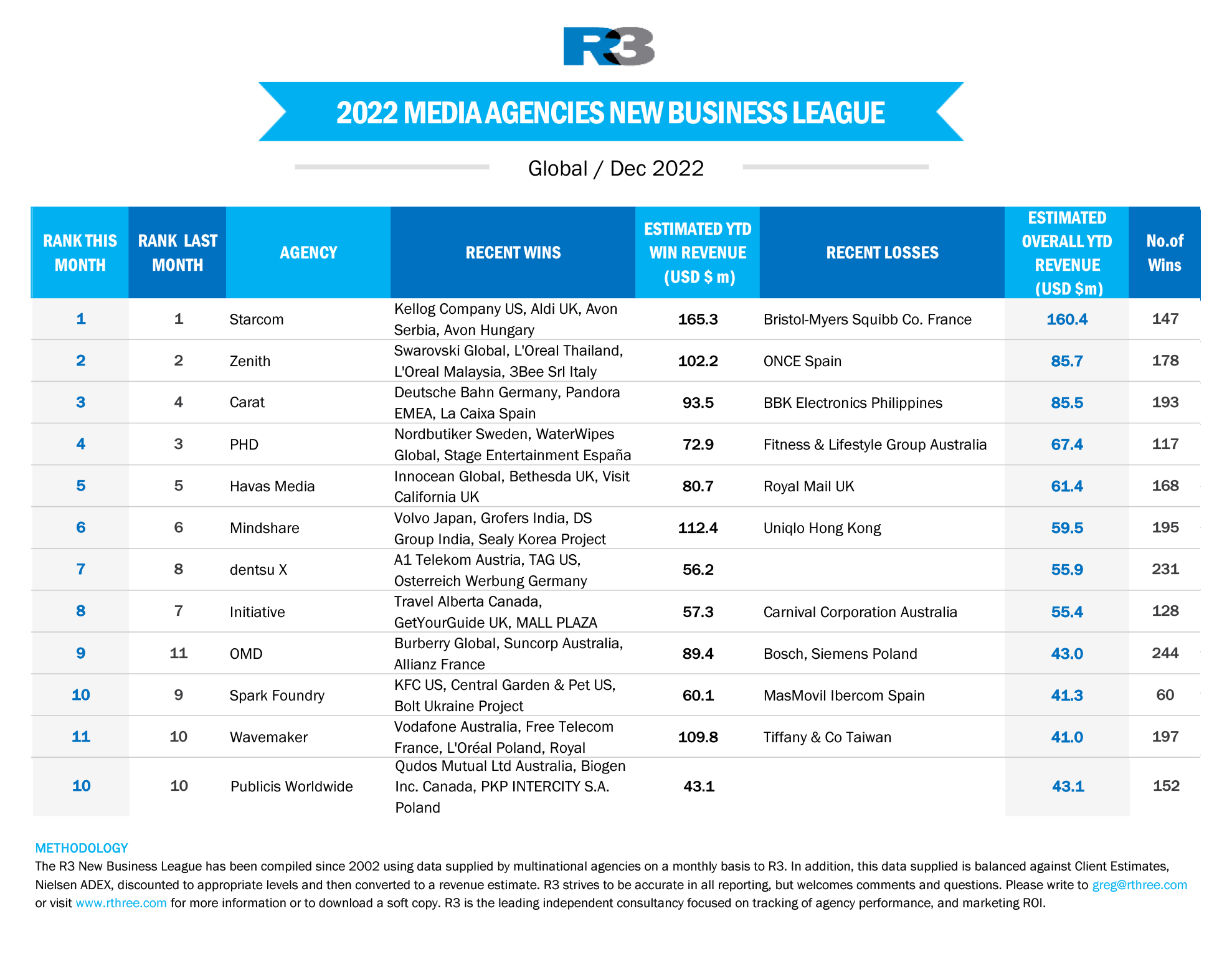

2022 was the year of growth for French holding companies, with Publicis Groupe and Havas leading R3’s New Business League. Publicis Groupe was holding company of the year with 2,249 wins and $804m in increased revenue, almost double the New Business increase of second placed WPP. The holding group’s leading media agency, Starcom also topped the Media Agency rankings, generating $165m in revenue, 60% more than sister agency Zenith in second place. Amongst creative agencies, French shop Havas led with $156m in overall new business revenue across 363 wins.

“Concepts like ‘Power of One’ and ‘Village’ resonated with marketers last year,” said Greg Paull, Principal at global independent consultancy, R3. “The biggest advertisers are consolidating their marketing with holding groups that presents a clear strategy for integration. Publicis Groupe has also leaned into the Sapient and Epsilon acquisitions to fuel expanded consulting and data solutions” he added.

US Pitch Value Decreases More Than 40%

Economic uncertainty in the US resulted in both Creative and Media pitches decreasing in value more than 40% year-on-year. Albeit challenges with its restructure, Interpublic’s R/GA led the Creative ranks, followed by Leo Burnett and VMLY&R respectively. Starcom outperformed all other US media agencies, followed by WPP’s Mindshare and Omnicom’s PHD.

“Looking beyond the top three agencies on the Creative leaderboard, the rise of new guard independent agencies in the US suggests that CMOs are looking for bold ideas that maximize value,” said Paull. “For the first time, agencies like OKRP, Barkley and Zambezi have entered the top ten, surpassing more established multinational agencies with longer heritage.” he added.

The AOR is Dead – more pitches, for smaller value than previous years

Overall, the value of new business decreased 35% year-on-year, though the number of pitches increased 11% from 2021.

“The race is heating up to diversify services beyond traditional Creative and Media,” said Paull. “The future is in eCommerce, Data and Performance Marketing and agencies need to sell more advanced solutions to clients. The biggest moves in 2022 have all been focused on the ability to serve the convergence of media, commerce, entertainment, and shopping.”

For Europe, the global trend was also prevalent, with 19% more pitches for 17% less revenue. Havas led creative agencies by some margin, followed by Publicis Groupe’s Saatchi & Saatchi and Digitas. For media agencies in Europe, Carat performed best followed by OMD and WPP’s Mediacom.

In Asia Pacific and China, Ogilvy and Zenith both led new business in Creative and Media. Havas ranked number one in Creative in both Europe and the UK. Asia Pacific saw a decrease in pitch value (-29%) and volume of pitches (- 2%).

For Latin America, it was a similar story with 3% more pitches than 2021, but for 20% less revenue. WPP’s VMLY&R led the way amongst creative agencies while Havas led all the media agencies for the year and ranked second amongst creative agencies.

Five of the Top Ten Global Creative Reviews were for Quick Service Restaurants

Amongst creative agencies, Quick Service Restaurants made up half of the top ten reviews with Burger King, KFC, Jack in the Box, Dunkin and Costa all finding new partners. “Post Covid, the pressure is on for this sector for results, and this year saw exceptional turbulence” added Mr Paull. Ford, Under Armour, SC Johnson and Walgreen’s also found new creative homes.

On the media agency roster, big decisions were made by AB InBev, McDonald’s and Kellogg’s (all won by Starcom), along with Amazon and Restaurant Brands appointing new partners.