Global brands face online headwinds. White paper lays out strategy suggestions for CMOs.

E-commerce has opened up new opportunities for global consumer packaged goods companies, especially here in Asia, but many still continue to lose overall market share.

A recent R3 white paper maps out the challenges facing CPG brands globally and suggests some strategies to help overcome them.

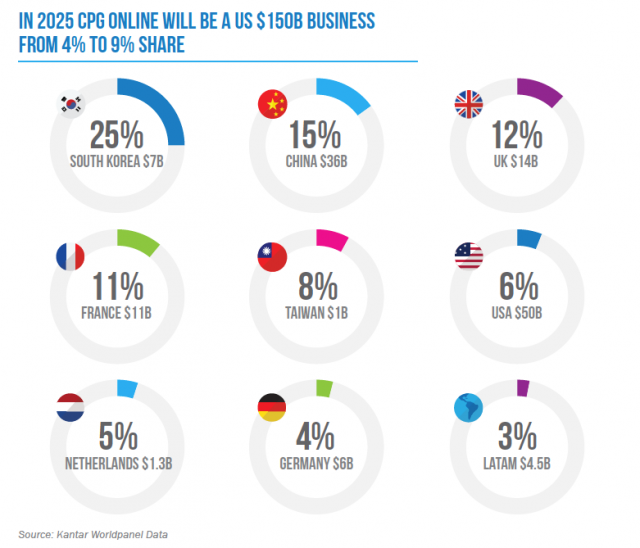

The case for e-commerce expansion in Asia relatively clear. First, the e-commerce part. More consumers are spending more time online through mobile devices and are shifting their consumption activities there, yet online CPG sales only form less than 2 percent of overall industry sales, according to a recent IRI report. Yet by the end of next year about half of CPG growth will come through e-commerce, says a recent Kantar study

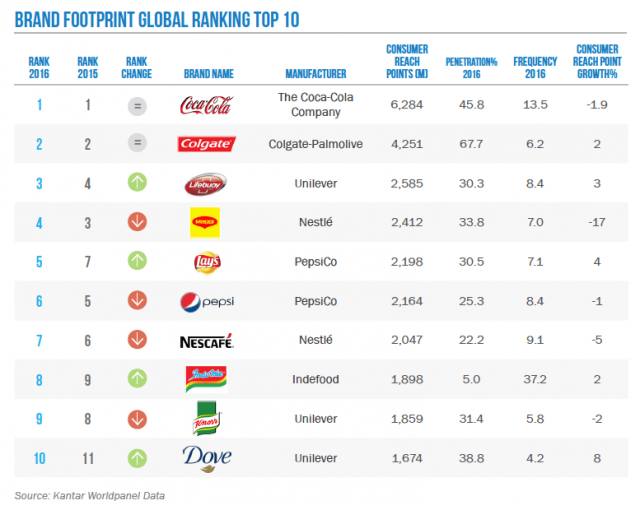

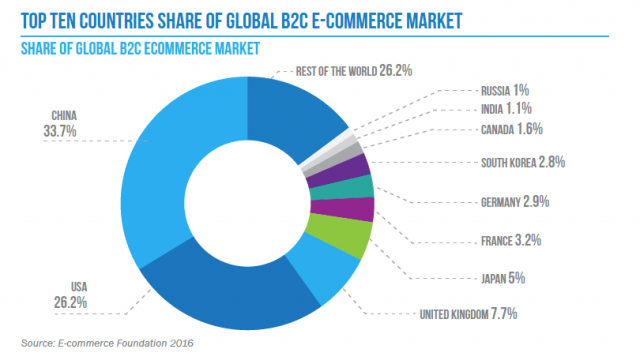

Asia, meanwhile, continues to be an e-commerce leader. China’s B2C online market ranks first globally with more than a one-third share. Markets like South Korea, China and Taiwan are expected to remain leaders in online CPG sales, according to Kantar, which also notes emerging markets now make up 82 percent of overall growth for CPG brands.

Yet the challenges facing CPG are numerous. The R3 paper outlines five major ones

1. Digital Disruption

Large online retailers like Amazon are using their immense market share to develop their own branded products. Meanwhile, “CPGs are paying online retailers to give them aggregate data on their own consumers but online retailers can leverage that data to take market share away from the very brands they are carrying,” R3 notes.

2. Changing Business Models

Some CPGs are trying to ‘cut out the middle men’ by going direct to consumer (D2C), mostly through acquisition, such as Unilever’s Dollar Shave Club. But this is a difficult model for F&B players who would need a lot more investment in their own distribution & logistics.

3. Scale vs. personalization

Global CPGs may have large scale, but largely cede control to retailers in reaching consumers in the right stage of their consumer journey. Meanwhile smaller upstarts do a better job of personalizing sales.

4. Rise of the Super-Consumer

The shared economy and the rise of millennial consumers reflect a growing demand for fast, easy service and delivery of all kinds of goods, requiring an omnichanel strategy for CPG firms.

5. Losing Share to Smaller Players

Consumer movements towards ‘buying local’ and niche products is driving more sales to smaller competitors, forcing CPGs to keep up through acquisitions.

With most challenges come opportunities, so R3 maps out five opportunities to help CPG brands expand e-commerce.

1. Deepen Partnerships with Online Retailers

It’s unreasonable to expect D2C to replace established retailers so brands need to work at ranking their products higher on these platforms through simple methods like improving SEO, building up consumer reviews and providing better product content.

2. Consumer Dialogue

Since most shoppers use their phones to inform their product purchases brands need to be present across a variety of mobile platforms to be there with the right information when consumers are looking.

3. Use Technology

Overcome “legacy disease” by using technology on both the front end and back end to improve dialogue and distribution through many channels.

4. Innovate for Consumers

Don’t just innovate products, but look to what consumers and want, where the industry is headed and develop new products than solve pain points.

5. Find the Right Partners

Digital-focused CPG brands need to bring in the right UX designers to improve consumer experience and the right marketing and advertising partners who can benchmark their effectiveness.

More specifically, R3’s advice to CMOs includes:

- Start with a small pilot program

- Invest in talent

- Know your competition

- Engage consumers on social channel

Source: Campaign